Primarily this blog is intended for recently qualified doctors and dentists starting work in a practice. Once you move on to acquiring assets and an ownership interest in the Medical Centre this will open up further opportunities for tax strategies and responsibilities. We touch on this towards the end so you can understand why some doctors have different circumstances to yourself. Before you acquire an ownership interest in a practice make sure you seek further professional advice. PCG 2025/5 will give you a good understanding of the limitations of splitting income even when in practice. https://www.ato.gov.au/law/view/view.htm?docid=%22COG%2FPCG20255%2FNAT%2FATO%2F00001%22

You are probably going to be invited to work in a medical centre where you will only receive a percentage of the fees you generate. The medical centre will probably charge you between 30 and 40% of your earnings to cover their costs. Sometimes with additional charges for materials. This all comes down to the individual contract.

The tax and GST responsibilities for Doctors turn on whether they are the one to receive the payment from the patient or Medicare or they are just paid by the Medical Centre. The GST outcome can vary dramatically so it is very important to understand the detail before you negotiate your contract. The supply of medical services is only GST free when it is provided direct to the patient. For example, if you bill the Medical Centre and the Medical Centre is the one who bills the patient then you must charge GST to the Medical Centre. The Medical Centre can claim the GST back so it should not make a difference to the net outcome. If you get this wrong you could lose 1/11th of your income when the ATO come looking. As well as being locked into a contract that means you are working for a lot less take-home pay than you thought. Please note, it is not a case of everyone does it this way, or that all contracts are the same. We have seen some very strange arrangements. In anticipation of you needing to push back during negotiations, references have been included here.

One of the worst cases we have seen is a young doctor straight out of university signed an agreement with a Medical Centre where they took 60% of his income and he got 40%. The Medical Centre was the one who billed the patient. The contract included the right for the Medical Centre to create a recipient created invoice for GST purposes. A recipient created invoice is a tax invoice created by entity making the payment but it is on behalf of the person receiving the payment. This effectively gives the payer the right to create the records that the Doctor is bound to pay tax on.

The Medical Centre claimed that the Doctor did not have to charge them GST because the doctor was providing GST exempt Medical services to their patients. So when the Medical Centre made out the recipient created invoice there was no markup for the GST. Marking up for the GST is not normally a problem because the Medical Centre simply claims that GST back and does not have to charge GST on the bill to the Patient and Medicare. But this Medical Centre dug its heels in and said that was the way it was always done, everyone does it that way. This is how the recipient created invoice was worded:

| Services Provided to Patients | $11,000 |

| Less: 60% fee to Medical Centre | $6,600 |

| Amount deposited into the Doctor’s bank account | $4,400 |

The Doctor could claim back the GST on the fees to the Medical Centre that is $600, so now they have $5,000 in cash. But as the Doctor was not the one charging the patient, GST applies to the whole $11,000. The doctor must send $1,000 off to the ATO in GST. Leaving the doctor just $4,000 or only 36% of the fees they have generated. Further, the Medical Centre would have been within their rights to claim that $1,000 in GST back off the ATO.

In actual fact, this situation is so controlled by the Medical Centre the Doctor should really be treated as an employee including having superannuation contributions made by the Medical Centre; but that is another issue to be aware of when you start to become an employer.

Here is the law to help you with your negotiations.

Doctor bills the Patient

In this scenario the doctor would just pay a fee to the Medical Centre for provision of services and facilities. Generally, 40% of patient fees. Though there may be some other charges for extra services or facilities. The Medical Centre probably handles all the administration for the doctor but all the fees from the patient and Medicare go into the doctor’s bank account. Then the Medical Centre invoices the doctor for their services.

GST

There is no GST payable on medical services provided to patients. To be clear about this here are the details of what is considered medical service. https://www.ato.gov.au/businesses-and-organisations/gst-excise-and-indirect-taxes/gst/in-detail/your-industry/gst-and-health

And here is what the Act says:

38-7 Medical services

(1) A supply of a * medical service is GST-free .

(2) However, a supply of a * medical service is not GST-free under subsection (1) if:

(a) it is a supply of a * professional service rendered in circumstances covered by a prescribed provision of regulations made under the Health Insurance Act 1973 ; or

(b) it is rendered for cosmetic reasons and is not a * professional service for which Medicare benefit is payable under Part II of the Health Insurance Act 1973 (or for which Medicare benefit would be payable under that Part if section 19AD of that Act were disregarded).GST free health supplies are not just limited to medical services they do include services provided by many allied health professionals, listed here https://www.ato.gov.au/law/view/document?docid=PAC/19990055/38-10

Even if the services you provide are not subject to GST you should still register for GST. Firstly, because GST free services still count in the turnover test. As you are likely to supply more than $75,000 in GST free medical services you will be required to register for GST. But more importantly, you want to register so that you can claim the GST back on your expenses. Just because you are making GST free supplies does not stop you claiming the input tax credits on your expenditure such as equipment, administration services provided by the Medical Centre, etc. Not all your expenses will include GST, for example education is a GST free supply in many cases.

This is how your numbers will look:

| Received from Patients and Medicare | $11,000 |

| 40% Fee from Medical Centre | $4,400* |

| Miscellaneous other expenses | $1,100* |

| Education Expenses | $500 |

| Income less Expenses | $5,000 |

| Claim back GST on Expenses in BAS | $500 |

| Cash left at the end of the period | $5,500 |

Don’t spend it all, put at least 1/3rd away for your income tax bill!

At the start, each BAS should result in a refund. At least until the ATO realise you are receiving all this income and not being treated as an employee. When you lodge your first tax return the ATO will realise no one has been withholding income tax for you. Your first tax return will result in a large tax bill. The ATO are not going to wait that long for the following year’s tax. They are going to want it paid by instalments during the year. Usually as part of your BAS even though it has nothing to do with GST.

Income Tax

You will be required to include in your income tax return all of the income received from providing your services. If any of your services are subject to GST then it is only the 10/11ths remaining after you send the GST to the ATO, that is included in your income. Similarly, as you will be entitled to GST input credits on most of your expenses then you only get a deduction for 10/11ths of the invoiced amount. Be careful, some of your expenses will not include GST, for example some of your courses and training may be GST free education.

When you lodge your tax return there will be a large tax bill so make sure you put some of your earnings aside, around a third to cover this. After the first tax return the ATO will ask for the tax to be paid in quarterly instalments based on an estimate from your tax return. This is only a method of collection. Next time you lodge a tax return those instalments will be taken into account and an adjustment made on the basis of actual tax due.

Using the example above this is what your tax return would look like:

| Received from Patients and Medicare | $11,000 |

| Less: | |

| 40% Fee from Medical Centre (ex GST) | $4,000 |

| Miscellaneous other expenses (ex GST) | $1,000 |

| Education Expenses | $500 |

| Income Tax Payable on | $5,500 |

Medical Centre Bills the Patient

This situation is really an employment arrangement. The Medical Centre should be withholding tax from the money you receive. They may dress up the contract to make it look like you are a contractor; that is at their risk. Some states will even catch the payments for payroll tax purposes. Interestingly, in Queensland there is a carve-out for payroll tax if the “general practitioner” is an employee. The twist is that trying to structure the arrangement as a contractor through another entity, is more likely to trigger payroll tax than the doctor actually being on the payroll.

When the Medical Centre bills the client and just pays the doctor a percentage of the fees it is very likely that the Medical Centre should also be paying the superannuation guarantee for the doctor. More about this in the discussion under locums.

From the Doctor’s point of view, just be careful that your contract doesn’t put all these obligations onto you. For example instead of simply 60% to the doctor and 40% to the Medical Centre, it might say 40% plus any payroll and superannuation payable by the Medical Centre. As long as you have that covered if the ATO or State Revenue come along later and want superannuation or payroll tax, that is the Medical Centre’s worry, not yours. Though if you feel you should have been paid the superannuation guarantee, you can apply to the ATO and they will recover it for you.

GST

When you bill a Medical Centre for your services you are not billing the individual patient, see section 38-7(3) below, and the supply is not GST free. This means that you must add 10% GST to your invoice to the Medical Centre. If the Medical Centre is preparing a recipient created invoice, make sure they include GST over and above the amount your agreement says you should receive. This is appropriate because the Medical Centre will simply claim the GST back in their BAS.

You will need to register for GST and claim the GST back on your expenses.

While the Medical Centre may just pay into your bank account the amount you generated less their fees, you are required to pay GST on the amount before their fees are taken out then claim the GST back on their fees etc. Make sure the Medical Centre give you a tax invoice to cover the fees they have deducted from your earnings.

Division 38 of the GST Act subsection 38-7 states that the GST-free services is the service provided to the individual/patient, not a Medical Centre:

(3)

A supply of goods is GST-free if:

(a) it is made to an individual in the course of supplying to him or her a * medical service the supply of which is GST-free; and

(b) it is made at the premises at which the medical service is supplied.

The numbers will look like this if you receive 60% of what you generate:

| Fees generated by your for Medical Centre | $10,000 |

| Plus GST (Medical Centre will Claim this Back) | $1,000* |

| Total amount to include on Recipient Created Invoice | $11,000 |

| Fees from Medical Centre plus GST | $4,400* |

| Amount Medical Centre Should Pay You | $6,600* |

| Payable when you lodge your BAS see * | $600 |

| What you get to keep in the end (before Income Tax) | $6,000 |

Income Tax

In this sort of situation it could be argued that you are simply a wage earner and the Medical Centre should be deducting tax from your payment as if it was wages. In reality they are unlikely to and you should be putting away a third of your earnings in anticipation, until the ATO starts collecting income tax from you in instalments, probably through your BAS.

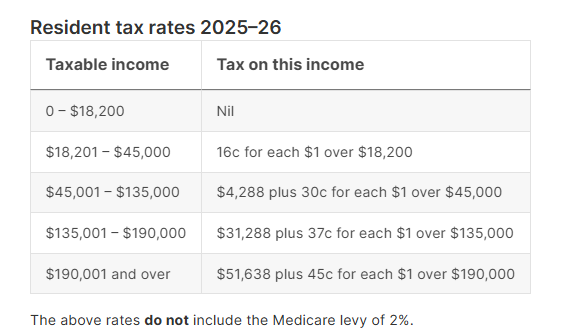

Your level of income tax depends on your estimated earnings for the tax year. Here are the current individual tax rates for a resident individual for the 2026 tax year:

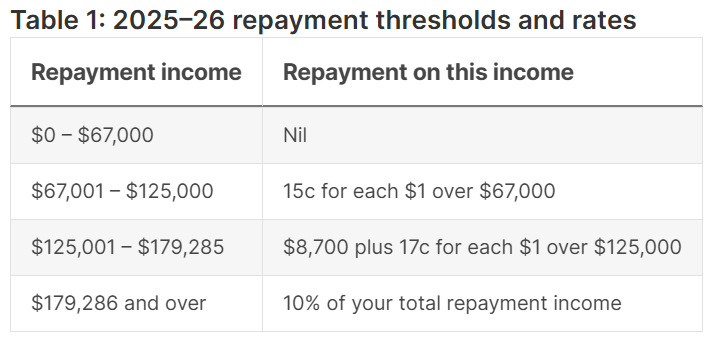

Consider putting even more than a third away if you have a HECS debt.

Here are the latest HECS thresholds and rates:

Your income tax return will include your income net of GST and expenses net of the GST you have claimed back. So from the example above.

| Fees Received from Medical Centre | $10,000 |

| Less: | |

| Fees Paid to Medical Centre | $4,000 |

| Other possible expenses net of any GST claimed in BAS | $1,000 |

| Taxable Income | $5,000 |

Deductions for Expenses

No matter the arrangement discussed above you should also keep records to ensure that you can claim the following tax deductions. Make sure you obtain a tax invoice so you can claim back the GST as well. Note as an enterprise ie not an employee, you are required to obtain the ABN of anyone you make payments to.

All the usual expenses to consider and keep receipts for, insurance, equipment, membership fees, accounting fees, Medical Centre fees, materials, education and training. Your deductions are very similar to doctors on a wage because there are limitations on paying income from personal services to related parties, this is discussed in detail further down. Things start to change once you start providing your client with significant goods or equipment services. Now to the more complicated deductions.

Home Office – This would be in regard to study, research and record keeping only, as your place of business would be the Medical Centre. This is probably a good thing, because if you own your home having that as a place of business can create problems with your main residence exemption.

As your home is not a place of business you are only entitled to claim the costs that increase with your work related use. You can keep a record of every hour used for work purposes and claim 70 cents an hour or you can record the actual costs and apportion on the basis of the area set aside for work related use.

If you are going to use the 70 cents an hour method you need to record every hour, including start and finish times, for the full year. Further, the 70 cents includes your mobile phone calls.

To be able to claim both your mobile phone and home office expenses you will need to use the actual cost method. When it comes to items that have both a private and business use you will need an one-month representative diary as a basis to apportion the expenses. When a room is set aside exclusively for work related purposes some expenses such as electricity can be apportioned on a sqm basis. We have a spreadsheet that will guide you through either method of recording your home office expenses, just ask your BAN TACS Accountant for a free copy. If you are not a client it is available here for just $7.95 https://www.bantacs.com.au/shop-2/home-office-2024-and-ongoing/

Phone – This requires a diary for one month recording the ratio of business to private calls so that the overall bill for the year can be apportioned. This is on a number of calls basis not the duration. The simplest way of doing this may be to take a screen shot of one month’s recent calls and write w for work or p for private against each call. Note that if you are claiming the 70 cents an hour method for home office you will not be entitled to claim your mobile phone costs.

Motor Vehicle – You are not going to be allowed a tax deduction for travel between home and the medical centre. This is the case even if you work at two Medical Centres unless you are travelling between the two on the same day without going home first (reference section 25-100 ITAA 1997).

Be alert to other travel that maybe claimable. For example, if you see a patient between home and the medical centre then the whole journey is deductible or house calls. Also record your travel to training and meetings that are not at your place of work. Record any travel that is connected with your job that is not straight to and from work travel, at least then you can discuss it with your Accountant.

If you think you are going to do more than 5,000kms for the year or you purchased a high value car in the last 8 years, you will be better off to keep a log book for three months. This will include the reason for the travel, where to and the speedo readings. Make sure you keep the speedo reading for the end of every financial year. More details below.

If you are only going to claim under 5,000kms per vehicle, you just need to keep a diary for a one month representative sample for each vehicle. If nothing is representative best keep a notebook in the car for the full year. Make sure you record the kilometres travelled, the reason for the travel and the destination.

If you want to claim any GST back on motor vehicle expenses you will need to keep a log book.

If you have just purchased a vehicle, as a small business, you may be able to claim an immediate write off for your motor vehicle purchase if it cost you less than $20,000. Though you will only be able to write off the business use portion of the price and you will need to keep a log book.

Further, when you purchase a vehicle have a look at the invoice, you may well be able to claim a portion of the GST back, another good reason for using the log book method.

The Log Book Method:

Keep for 12 continuous weeks every 5 years. You must also record your speedo reading every 30th June.

The exact requirements are available here https://www.ato.gov.au/law/view/document?DocID=PAC%2F19970038%2F28-125&PiT=99991231235958

In summary record the date of each journey, opening speedo, closing speedo, reason for the journey and where to. Have a column for private kilometres and business kilometres, calculate the kilometres for the journey and initial the entry to show who is making it. Note there is a legislative requirement to make this entry as soon as practical after the journey ends and as soon as the 12 weeks period ends you should calculate the percentage of business use. You do not have to record private kilometres but it is best to do so to keep the habit and allow you to pick up the opening speedo reading from the previous trip if you forget to record it at the start of a business trip.

Keep receipts for all expenses. If the vehicle has a pay load capacity of less than 1 tonne you can do an annual fuel test rather than keep all your fuel receipts. A fuel test involves noting the speedo reading when you fill up, then next time you fill up noting the speedo reading again and keeping the fuel receipt. This will allow you to work out how many cents of fuel you use per kilometre. As you are taking the speedo reading every 30th June you know the kilometres travelled for the year, so you can estimate your fuel cost. Note if you are claiming the GST back on your fuel you will need to keep all your fuel receipts anyway.

5,000 Kilometre Method:

This method simply requires a detailed reasonable estimate of the kilometres travelled. You are allowed to claim a maximum of 5,000 kilometres, a year using this method. Note this is 5,000 kilometres per car, per owner of the car. So, in the case of joint ownership each owner could technically claim up to 5,000 kilometres.

A detailed reasonable estimate means that you can’t just claim 5,000 kilometres, you need to show how you worked this out. Consider keeping a diary of the kilometres travelled for each normal work related trip, for a month as a representative sample. Also recording each one-off unusual trip during the year.

Travel – Meals and Accommodation

These are only going to be tax deductible when you need to sleep away from home overnight. The reasonable allowance supposed concessions do not apply unless you receive a travel allowance from your employer, so do not apply in your case. To claim any meals and accommodation you simply need to keep receipts for every single expense, and a travel diary if you are away from home for more than 5 nights.

Relevant Courses and Further Learning

Keep receipts for the course cost of course, but also consider travel costs as discussed above, if it is necessary to sleep away from home overnight. For courses, the agenda can serve as your travel diary if you are away from home for more than 5 nights.

Don’t forget to claim your motor vehicle as described above. Travel from home to a place of learning and back home again will be tax deductible. But the ATO is very careful to emphasise that travel from home to work is not tax deductible.

If you go to the place of learning and work in the same day the trip either side of work would not be tax deductible. If you go from home to place of learning, that trip is tax deductible but if you then go from place of learning to work that leg is not tax deductible. Same in reverse from work to place of learning not tax deductible unless you are going to return to work afterwards. But travel from the place of learning to home is tax deductible

Small Business Tax Offset

This could result in $1,000 reduction in the tax you pay, which is worth more than twice as much as a tax deduction, so make sure it is not overlooked. This can apply if the income you receive is from operating as a sole trader, partner in a partnership or trust; but not a company.

The Small Business Tax Offset cannot apply to personal services income caught by Division 86 and 87 (discussed in detail later), usually referred to as the 80/20 rule or results test. If the doctor is billing the patient for consultations and provide their own basic equipment then they will pass the results test and not be caught under the PSI rules. The problem arises when the doctor does not supply their own equipment for example an anaesthetist then they do not pass the results test. There is another test they may pass commonly referred to as the 80% or 80/20 rule. That requires at least 80% of income is received from at least two unrelated parties through advertising. Fortunately, when it comes to income you receive from Medicare it is the number of patients that you see not the fact that all of your income comes from Medicare. Note if it is the Medical Centre that is billing the patients ie their ABN is on the invoice not yours, even though your provider number is on the invoice, it is considered that you only have one payer paying you, the Medical Centre and you will miss out on this tax offset.

Making Superannuation Contributions for Yourself

As your payer is unlikely to be making superannuation contributions for you, you will be entitled to contribute $30,000 a year on your own behalf. If you do have an employer making some contributions for you then that will reduce the $30,000 threshold. The superannuation contributions you make for yourself will qualify for a tax deduction at your marginal tax rate and only be taxed at 15% going into the superannuation fund. Beware that if your income including super contributions exceeds $250,000, there will be an additional 15% tax on both the deductible superannuation contributions you make for yourself and the ones made by your employer, if applicable.

If you have less than $500,000 in superannuation you may be entitled to contribute more than $30,000 for the year. This is called the unused cap. Look back over the previous 5 years before this year for any times you did not utilise the full cap, you can catch up now and claim a deduction. As a new graduate this may be a great advantage to you considering your low income while studying. There is bound to be some unused cap, and you need to catch up anyway.

The unused cap is only triggered when your current year contributions exceed $30,000. Each year a previous unused cap drops off so to maximise this concession aim to put in at least $30,000 plus the full amount of your oldest unused cap.

Don’t worry too much if you go over your unused cap or don’t qualify. While the money will be locked away in superannuation (which is mostly a good thing) the excess will go towards your non tax deductible, non concessional cap. You will not get a tax deduction for the excess but it will not be taxed going into the superannuation fund, up to a limit of $120,000 per year though you can draw forward some or all of the next 2 years non concessional cap.

Locums

Locums, in the majority of cases, would be treated the same as already discussed.

There are a limited set of circumstances when a locum may be considered an employee of the Practice. If that be the case the practice should withhold tax from your salary and send to the ATO on your behalf. They should also make superannuation guarantee contributions for you at a minimum rate of 12%. If you are an employee then you do not need to register for GST. You will still be entitled to income tax deductions as discussed above.

The ATO states (reference TR 2005/16 https://www.ato.gov.au/law/view/pdf/pbr/tr2005-016.pdf ) that in the following circumstances a Locum would be considered an employee:

- The Locum is simply paid an hourly or daily rate for the hours they attend the clinic.

- The practice sets the hours the Locum is to attend

- Nearly all the equipment the Locum uses is provided by the practice

- The patients are billed under the practice’s ABN, obviously quoting the Locum’s provider number.

- The Locum does not have the right to organise someone else to work in their place.

- Even if the Locum receives a percentage of their earnings for the day, if all the other control factors above apply, they may still be considered an employee.

If, from the above it appears you are an employee, yet your employer does not treat you as one; that is mainly their concern. From your point of view, you only need to consider that you will be caught by the Div 86 and 87 PSI rules because you don’t pass the results test and you are being paid by the practice not by the patient or Medicare. Being caught under Div 86 and 87 in your circumstances probably makes no difference. The only restriction likely to affect you is that you would not be entitled to claim for any wages paid by yourself to family members to help you with administration. If you are travelling as a locum with your spouse who may provide reception duties it is better that they are independently employed by the practice.

Travel, meals and accommodation by Locum – There is an opportunity for a Locum to claim their travel if they are itinerant. That is you travel to more than one workplace before returning home, maybe house calls. Or you are travelling between two places of work without returning home, maybe two clinics in the one day. Travel from your usual residence to a regular practice on a daily basis would just be considered non deductible home to work travel unless there is a need to carry more than 20 kgs of equipment with you as there is no safe storage at work.

In the case of Locum placements that involve living away from home for a period of time, it is quite possible you will be able to claim your motor vehicle expenses to travel from your home to the locum position because you will need to carry 20kgs of equipment to set yourself up there.

As you will be required to sleep away from home for a period of time, you may be entitled to claim meals and accommodation in limited circumstances. The crux of the matter is whether they are incurred as part of travel required in your work, or whether they are incurred simply because you choose to have your home too far away from your work. For example if you were employed to travel from one clinic to the next on a continuous basis, never staying anywhere for longer than a few weeks and still had a home base you would be considered travelling for work and entitled to claim your meals and accommodation, though one would expect in those circumstances your payer would have covered that for you. Keep receipts for any of these costs that you incur and make sure you keep a diary if you are away from home for more than 5 nights. Of course, in these circumstances you would also be able to claim your car expenses because you are itinerant. Somewhere between 3 weeks and 2 months in the one place, and the ATO will consider you to have relocated your home to that place, so you will not be entitled to a tax deduction for your meals and accommodation. If you are an employee staying in an area for more than 2 months discuss a living away from home allowance with your employer. This is a tax free allowance you can receive that is FBT exempt for the first year.

Splitting Income

The opportunity to split income is not available when the income is from the provision of your personal services. There are specific requirements in Division 86 and 87 of the 1997 ITAA on when income is considered to be personal services. You may have heard about the results test and having 80% of your income from more than one source.

Division 86 considers doctors who bill Medicare direct to have more than one payer because it is the underlying patients that count. So providing you are billing the patients or Medicare and you provide your own equipment such as blood pressure monitor you will pass the results test and not be caught by Div 86 and 87. If you do not supply your own equipment, for example a surgeon that has the use of hospital facilities but not a lease over the operating theatre then you do not pass the results test because you are not supplying the necessary equipment to do the job. There is a window here, only 75% of your income has to pass the results test so if you also consult with patients using your own equipment and that generates more than 75% of your income you will pass.

If you can’t pass the results test there is another opportunity if at least 80% of your income comes from at least 2 unrelated sources as a direct result of advertising. As long as you are not paid by the hospital or Medical Centre, as long as it is you billing the clients with your ABN you should be able to pass this test if you advertise.

Certainly, if you work in a Medical Centre that bills the clients under their ABN and just pays you a percentage you are caught out by Divisions 86 and 87. Further your payer should really be treating you as an employee with wages and superannuation benefits. .

Consider if you are a surgeon or a specialist who reads scans from very expensive equipment provided by the hospital you may not pass the results test because you are not using your own equipment. If you pay the hospital to use its equipment you would satisfy the results test. Otherwise, you need to look to the 80/20 rule which you will pass if you are billing the patients direct.

That takes care of Division 86 and 87 but the next hurdle is Part IVA. This requires the income to be from a business rather than your personal services before you can split income. Examples of this would be primarily from the use of equipment or where the majority of the income that is billed for personal services is for the services of employees rather than the owners. When you have the opportunity to expand into this area you need to seek advice. Further reading PCG 2025/5 https://www.ato.gov.au/law/view/view.htm?docid=%22COG%2FPCG20255%2FNAT%2FATO%2F00001%22

If you can pass the Division 86 PSI rules you will be allowed to claim a deduction for payments you make to your spouse but Part IVA means that you must be able to justify the cost. This will mean your spouse keeping a diary of hours worked and the rate of pay must be typical for the work done. There is a small window here. Ryans case (2004) reference TD 2005/29 set the precedent that while wages paid to a spouse or other family member has to be justified in work performed there is no limit (other than the $30,000 cap) to the amount of tax deductible superannuation contributions you can make for your family Member.

Julia's Blog

Julia's Blog