Category «Property Investments»

Make Hay While the Sun Shines – Claiming Interest During Construction of a Residential Rental

(Download PDF) The ATO have issued a draft ruling on claiming expenses when you are constructing a rental property. TR 2021/D5 https://www.ato.gov.au/law/view/print?DocID=DTR%2FTR2021D5%2FNAT%2FATO%2F00001&PiT=99991231235958&fbclid=IwAR0IAFNOdKMzqPcho6-FIEI6-cOFGjggwMwWMflgbmx46UbHamRM2ZYDyJ8 From 1st July, 2019 the deduction of expenses relating to vacant land have been severely restricted. Specifically, in regard to the costs associated with vacant land that you are holding to build a …

Hybrids are being Spruiked Again!

Claiming Property Expense When Not Rented

Claiming Property Expense When Not Rented The big question is – “What is Exceptional Damage Beyond Your Reasonable Control?” The answer in the case of the above photo would depend on a DNA test because if your family does the damage, no tax deduction. What a segue! Sounds a lot more interesting than discussing …

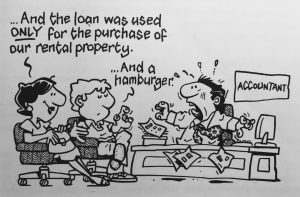

Keeping the Nexus Between the Borrowing and the Expenditure

Keeping the Nexus Between the Borrowing and the Expenditure What the borrowed money is used to buy determines whether the interest on the loan is tax deductible. That is the basic rule. The link between the borrowing and the expenditure is called the nexus. This nexus needs to be very clear. You need to be …

Julia's Blog

Julia's Blog