Category «Superannuation»

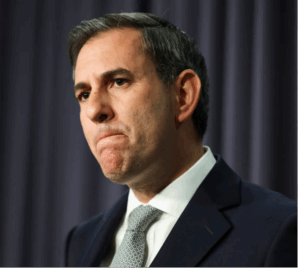

Jim Charmers Backs Down on Taxing Unrealised Capital Gains in Superannuation

Download PDF If you have close to $3mil or more in superannuation you are probably already aware that the government is rethinking its previously announced policies on large superannuation balances. At this early stage nothing is certain, there is still to be much consultation before the law is drafted. This blog is written to …

Special Bulletin – SCAM ALERT

“Scams don’t just steal your money — they steal your peace of mind.”— Unknown Sadly, the world is being taken over by AI — and with it, a tidal wave of fake content. This morning alone, my inbox has been flooded with reports of scam emails spreading blatant lies about superannuation. These messages claim that super withdrawals are being …

Stop, Plan, Financial Year End is Nigh!

How to make your own super contributions

Last Updated: 12th May 2023 Download PDF If you want to make a superannuation contribution and claim it in your 2023 tax return you best get a wriggle on. The contribution has to be safely in the superannuation fund by the 30th June. This post addresses the practicalities of making the contribution and dealing with …

Julia's Blog

Julia's Blog