Well not much to report this year! Our annual budget blog concentrates on giving the detail on issues that affect our clients tax, income, superannuation and businesses. Afterall you can read about the hype anywhere it is getting the detail and how it affects you that we are looking to provide. This budget did not change much for taxpayers and small business tax but did extend some concessions.

Personal Tax

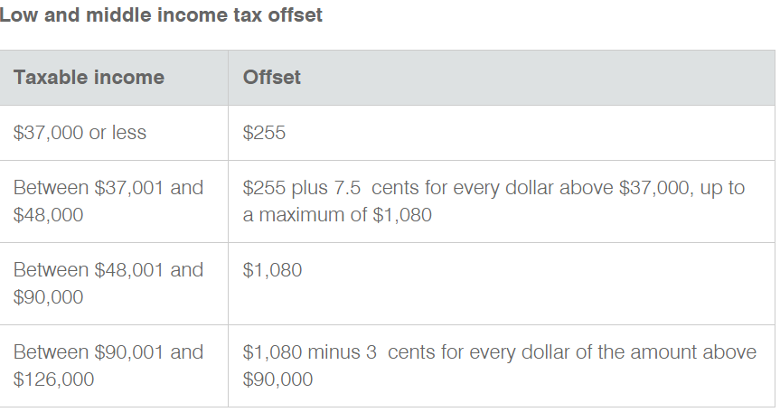

You can expect to continue to get that extra $1,000 or so when you do your tax return. The low to middle income tax offset has been extended to include the 2021-2022 financial year. The exciting thing about this offset is it is not paid to you each week. It only applies when you do your tax return, so it makes us look like Santa Clause. Other than the extension of another year everything else remains the same:

Superannuation

From 1 July 2022 the work test will be removed for people wanting to make non-deductible contributions to superannuation when aged between 67 and 75 years of age.

Certainly, a win if you want to make nontax deductible contributions. You get the $110,000 cap for each year and at any time up until you turn 75 you can bring forward another 2 years of the $110,000 cap even if that is dipping into the years past 75, just as long as you are under 75 at the time of the contribution.

When it comes to tax deductible contributions, that is the $27,500 cap, you will still need to satisfy the work test but at least you can make them all the way up to turning 75. The work test is working for 40 hours in a 30-week period.

If you work less than the 40 hours you can still salary sacrifice all your wage into super if you are under the $27,500 cap.

Once you get to 75 the only way you can contribute to super is through the downsizer contribution concession, when you sell a house, you have lived in. Downsizer contributions can be made by people aged 65 or over up until 30th June 2022 then the age threshold drops to 60.

Businesses need to be on alert regarding small wages. Currently, as long as the total wage paid was under $450 per month no superannuation guarantee was necessary. From 1st July 2022 this minimum threshold will be removed so you need to make sure your pay system triggers the guarantee for all adult wages. It is expected that the carve out for wages paid to under 18 year olds working less than 30 hours a week will continue.

Businesses

The immediate write off for plant and equipment has been extended, another year, through to 30 June 2023. So, the message here is do not rush, let us see how the economy recovers. For full details of how this operates refer to our blog https://bantacs.com.au/Jblog/the-25k-immediate-writeoff-clever-trick/#more-201 Basically any expenditure on plant and equipment can be immediately claimed as a tax deduction instead of being depreciated. Of course, this is not always the best tax outcome and as the law currently stands if you are a small business entity using simplified depreciation rules you must use instant asset write-off on all eligible assets. No being selective to make sure you do not waste your tax-free threshold. The government is aware of this problem and proposes to make changes to allow businesses to choose what equipment they write off, but those changes were not included in the budget papers.

The loss carried back concession has been extended by another year. If your business operates as a company (but not corporate trustees) it can go back and effectively reduce its profit in a previous year by a recent loss thus obtaining a refund of some of the tax paid. That is the best way to explain it, but it is all done in the tax return of the loss year. The first tax return this can apply to is the 2021 financial year, it is also available for losses made in the 2022 and 2023 year. The business can only go back looking for profits as far as the 2019 financial year. Note you cannot obtain a refund of tax if it will reduce the company’s franking credit balance below zero. In other words, you cannot claim back tax paid by your company if you have already used it to frank dividends.

These two concessions could be combined by immediately writing off plant and equipment to create a loss in the company that can be carried back to a previous year’s profit resulting in a refund of some tax paid in a previous year.

Another concession for small business companies (aggregate turnover less than $50 million) is a reduction in their tax rate down to 25% starting from 1 July 2021.

There is more assistance in employing and training young people but no solution for the immediate skill shortages. The following assistant packages are available, some are already in place, some have been extended:

Jobmaker Hiring Credit – It will be paid quarterly in arrears, and available for up to 12 months from the date of employment of the eligible employee, with a maximum amount of $10,400 per additional new position created. Employers will need to demonstrate that the new employee will increase overall employee headcount and payroll. This only applies to employees who work more than 20 hours per week, and were previously on Jobseeker, Youth Allowance or Parenting Payment for at least 1 month in the previous 3 months. The uptake so far has been a fraction of what was anticipated. The subsidy is:

$200 pw for employees 16 to 29 years of age

$100 pw for Employees 30 to 35 years of age

Apprentices and Trainees – A 50% wage subsidy is available for new apprentices or trainees. The maximum subsidy is $7,000 per quarter, per employee, for a total of 4 quarters. The subsidy is paid in arrears and is available for wages paid from 5 October 2020 right through to apprenticeships signed up by 31 March 2022. Of course, you to have apply, places are limited, and the apprentice or trainee must be undertaking a Certificate II or higher qualification and has a training contract that is formally approved by the state training authority.

Home Buyers

Loan Deposit Scheme:

The government will back 18% of the 20% deposit to buy a home for single parents with dependent children. This means they will be able to buy a home with only a 2% deposit. Of course, the big question is whether they will be able to afford the repayments on 98% of the purchase price instead of 80%. Great initiative because it avoids the very wasteful mortgage insurance but probably does not make housing more affordable, just easier to get into which may just push prices up.

This incentive is available for people who have previously owned a home as well as first home owners. It specifically states as one of its objectives that it is to help single parents re enter the property market. https://budget.gov.au/2021-22/content/essentials.htm#eight

There is also a similar arrangement to allow all first homeowners to purchase a house on 5% deposit with government backing. The number of these packages offered has now been increased by 10,000.

First Home Buyers Saving for a deposit through Superannuation:

No this is not using your employer contributions for a deposit, but it may allow you to withdraw your voluntary contributions even if you have paid them from before tax dollars or claimed a tax deduction for them. There is a top up tax on the withdrawal that is not as bad as if you had paid normal tax on the amount. Though the scheme can be a bit of a tax rort in the governments favour if you are not careful.

This concession has been around for four years now, the budget will increase the maximum amount that can be saved this way, from $30,000 to $50,000 from 1 July 2022. Other than the cap and some discretion to the ATO to be lenient when mistakes happen, the scheme stays basically the same.

The way it works is best explained by an example. Let us say $10,000 in pre-tax earnings is put into superannuation to save for a home deposit and your tax rate is 35% to keep it simple. The $10,000 will be taxed 15% going in so you will have $8,500 invested. If the money were outside of superannuation, you would only have $6,500 invested after paying 35% tax.

The amount you will be deemed to have earned on that $8,500 is 3% a year. After the 15% superannuation fund tax that is another $217. But is it really? As Noel Whittaker will say it is not wise to invest in the share market if you only have a time frame of a few years. So, what else are you going to do with that money in super other than keep it in cash? Probably earning only 1.5% and the superannuation fund is probably charging you 1.6% in fees. So, your money is very slowly going backwards and the 3% you think you are receiving in earnings will come out of your other balance for example your superannuation guarantee contributions. In reality, it is negative interest.

Now when the time comes to buy your home you take out your deposit. This will be taxable income in the year you take it out. Taxed at your marginal tax rate but with a 30% tax offset so just taxed at 5% if you are in say the 35% tax bracket. By the way, the ATO will withhold this from your payment so you will not get the full $8,500 plus 3%.

So, let us relook at the numbers and ignore the earnings because we have realised that after fees, they are probably negative. You started with $10,000 and ended up with $8,075 ($8,500 less 5% tax) instead of only $6,500 if you had paid your 35% tax at the start. That is a saving of $1,575 or 15.75% in tax, not bad.

But what happens if in the meantime you commit to a spouse who already has a home, and you would rather use the money to reduce the mortgage. Maybe you inherit a house or are posted overseas. Your work may become unreliable or transitional to the extent you may not be able to live in the house for the required 6 months. What do you do about the money you have locked away in super? Well, you can leave it there until you retire, or you have the option to remove it but there are tax penalties that mean you will end up paying more tax than if you had simply paid tax on the $10,000 in the first place.

This is how it would work. Your $10,000 would be reduced to $8,500 going in due to the 15% superannuation contributions tax. When you draw out that $8,500 it will have to go in your tax return as taxable income with the 30% tax offset as above and you have a year to buy a house but if you do not then there is another 20% tax on that $8,500 in your next tax return. That is $1,700 plus the 5% which was $425 and the $1,500 contributions tax going into the superannuation fund. A total tax on the original $10,000 of $$3,625 whereas if you had just paid your tax up front you would have only paid $3,500.

So, it is important to make sure your crystal ball is working before you commit to this strategy. $125 might not be much but if you utilise the full $50,000 withdrawal that is a total of $735 in extra tax plus all those superfund fees, just for trying to do what the government is encouraging you to do but your circumstances change.

Residency for Tax Purposes

Individuals:

This has been quite a difficult area of late as the ATO tries to get its hands on the earnings of Australians who have been living and working overseas for years. The ATO have lost a few cases in the courts lately.

The test will now be simplified to a question of where you physically are and if you are in Australia for more than 183 days in any financial year you will be considered a resident of Australia for tax purposes. Though any double tax agreement can override this by finding that you are a resident of another country, double tax agreements have tie breakers.

But if the ATO do not catch you out with the 183-day test there is still room to argue that you are a resident on the following basis:

• You have a right to reside in Australia

• You have accommodation in Australia

• Your close family is in Australia

• You have economic connections with Australia

It is proposed that you would have to be caught out in two of these 4 points to be considered a resident though nothing was made clear in the budget. So, what we are really left with is that the ATO wants to use legislation to override the cases they have lost lately but they are not sure how they want to use it because it is a double edged sword.

SMSFS:

From 1st July 2022 if you have a SMSF you (and the other fund members for that matter i.e. spouse) can move temporarily overseas for up to 5 years and still be allowed to control the SMSF from overseas and make contributions to it while overseas. The current situation is that you can only do this for 2 years. Of course if you are leaving the country for good then you have to wind it all up before you leave.

Julia's Blog

Julia's Blog