This is going to benefit all small businesses. We are even talking about your monthly Xero, MYOB or Quickbook subscription and the like. For every dollar you spend you get a tax deduction of 120%. Having only just made their way through parliament these extra deductions apply to expenditure incurred from 29th March 2022 but you don’t get to claim the 20% until your 2023 tax return. The training boost also applies to the 2024 tax return.

You can probably hear the groaning from you Bookkeeper and Accountant. Of course, you can only record in your accounts and BAS the amount you paid. It will just be at the tax return stage that the amount will be adjusted to claim an extra 20%.

You don’t want to pay your Accountant their hourly rate to sort through your records and look for expenses that might qualify. So, the onus is on clients to set up a separate account to record this sort of expenditure. You can have a few different accounts if you like but all the relevant expenses need to be recorded just in these accounts to keep the processing costs to a minimum.

The purpose of this blog is to give clients the information they need to decide what should go into these accounts. There are two different boosts with different thresholds and finishing dates so it is important that you account for the technology boost separate from the training boost.

Technology Boost

If you can’t find something to claim on for this, you are probably not in business! Look at anything to do with your computers. It even looks like you can claim the boost on your mobile phone. More detail in the table further down. There is a cap on the Technology boost of $20,000 for the period 29th March 2022 to 30th June 2022 and then another $20,000 for the period 1st July, 2022 to 30th June 2023. That means you are looking for up to $100,000 worth of expenditure in each year to get the extra 20% on. That is a possible total of an extra $40,000 in tax deductions but you actually claim the boost in the 2023 tax return so that extra information you have to pull together is needed right back to 29th March 2022 to do your 2023 tax return.

The Technology boost only lasts till 30th June 2023 so no need to worry about dissecting your accounts going into the 2023-2024 financial year. If the expenditure is for plant and equipment it must be installed ready for use by 30th June, 2023. As the legislation only just got through parliament at the end of June 2023 it is really too late to adapt your behaviour so you have got to ask what incentives did this create? If you are reading this before 30th June 2023 consider paying your qualifying subscriptions up to a year in advance.

What qualifies?

The legislation says expenditure wholly or substantially for the purposes of your digital operations or digitising your operations. So there doesn’t seem to be a need for you to actually do something new.

Expenditure on in-house software is not included. This is discussed in detail in another blog here https://www.bantacs.com.au/Jblog/when-is-the-cost-of-software-development-tax-deductible/#more-806 Basically it means software your workers develop for use in your business.

Other items that are excluded are wages, buildings, interest, education costs (there is a different boost for this) and expenditure that is included in trading stock.

It does include plant and equipment like computers and laptops. If there is some private use of the plant and equipment and you are not operating as a company or trust then you can only get a boost for 20% of the portion of the price that applies to the business use. In the case of the equipment being owned by a company or a trust it would be 100% used in the business as the private use is a fringe benefit supplied to employees.

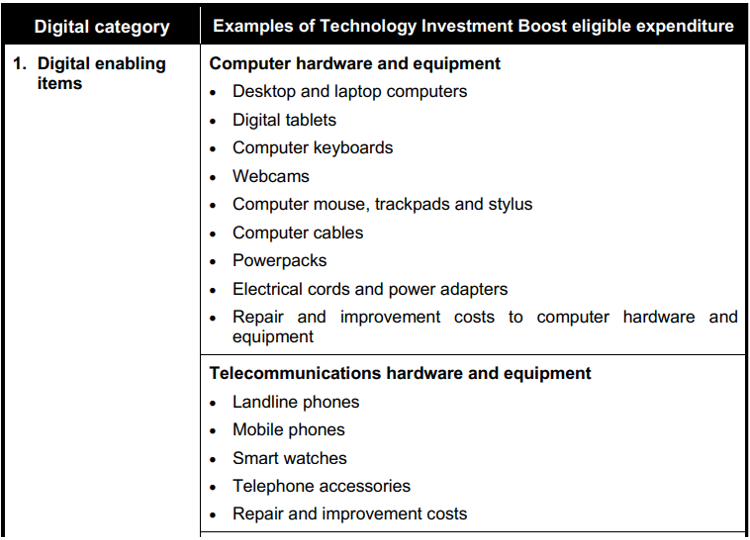

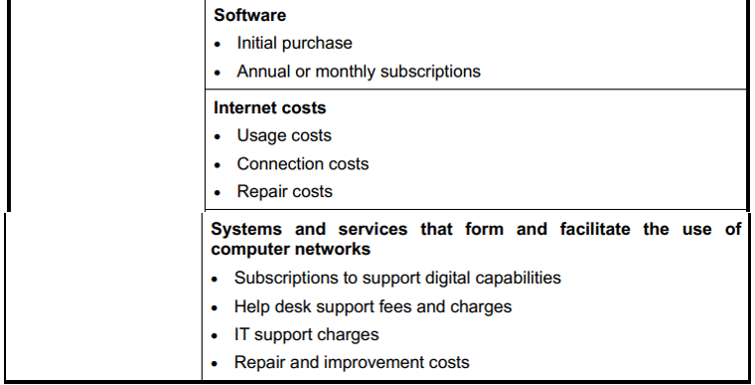

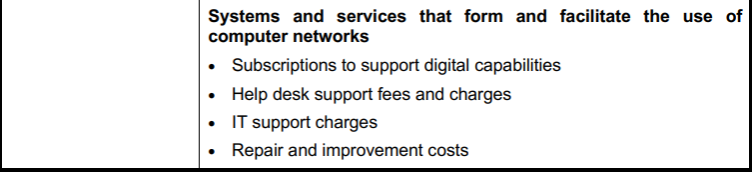

Clearly there is no restrictions on subscriptions or software purchases. Consider your accounting software, web site maintenance, cloud storage and security software. The explanatory memorandum (EM) lists, telecommunications hardware and equipment, software, internet costs, systems and services that form and facilitate the use of computer networks.

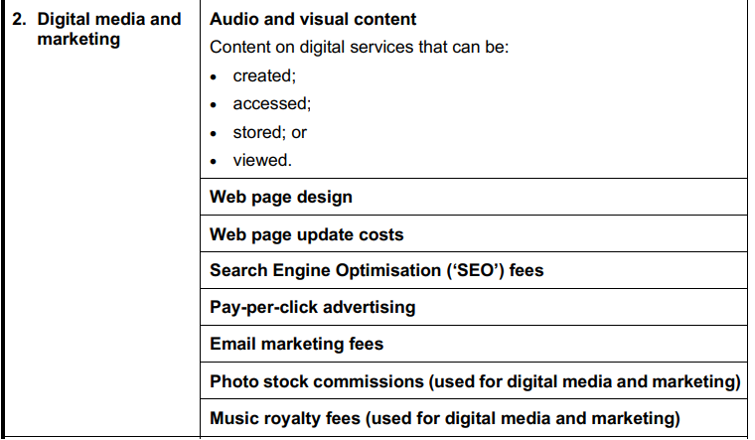

Digital media and marketing costs – including audio-visual content that can be created, accessed, stored or viewed on digital devices and web page design.

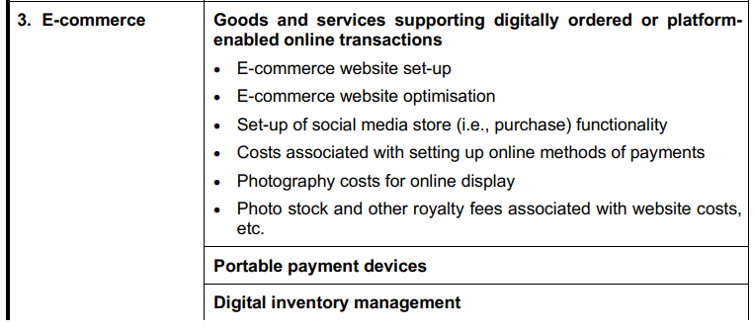

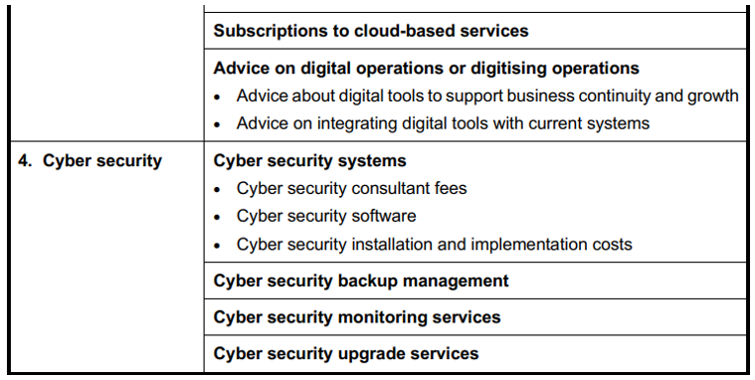

E-commerce – Including goods and services supporting digitally ordered or platform-enabled online transactions, portable payment devices, digital inventory management, subscriptions to cloud-based services, and advice on digital operations or digitising operations (e.g., advice about digital tools to support business continuity and growth).

Cyber security – Including cyber security systems, backup management & monitoring services.

It is clear in the EM that the intention is to take a wide view so there is a lot of opportunity here. To get you thinking, here is a non-exhaustive list.

Update from the ATO:

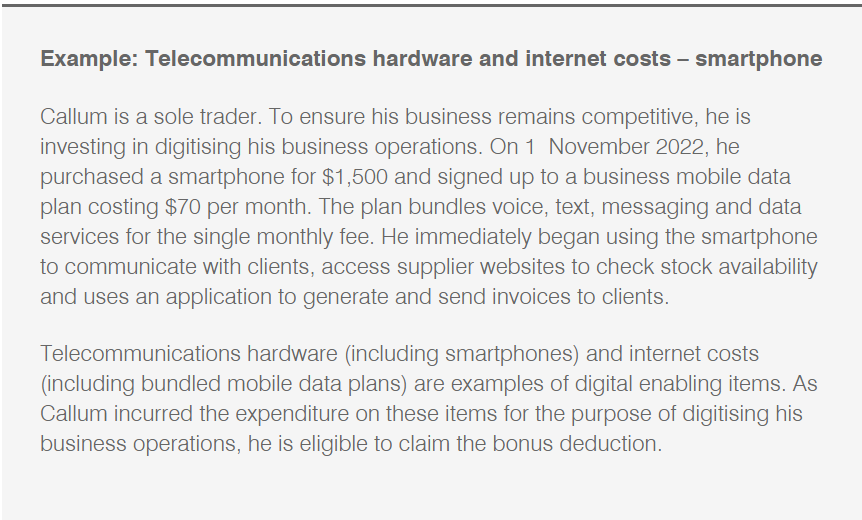

The ATO has provided some clarity on claiming your mobile phone costs under the technology boost https://www.ato.gov.au/Business/Income-and-deductions-for-business/Deductions/Small-business-technology-investment-boost/?#Eligibility

Yes, you can get an extra 20% tax deduction on the purchase of your phone and your mobile phone bill from 1st March 2022 to 30th June 2023, if you are in business of course. Note if you are a sole trader then it will be only an extra 20% on the portion of the phone that is used for business.

Skills and Training Boost

This also starts at 29th March 2022 but runs for an extra year finishing on 30th June 2024 so you need to be keeping your records for this expenditure separate in the 2023-2024 year too. It is the enrolment in a course or the arrangement of the provision of training that needs to occur after 29th March 2022. As long as the training has been paid for before the 30th June 2024 it will qualify for the boost even if the course has not yet been undertaken. Some employers might consider reimbursing their employees that are studying. This will not work because the payment is to an employee not to a registered training provider. The employer would need to get in first and pay the cost up front to the educational institution.

There is no cap on the amount of training boost that an employer can claim.

The training can only be provided by a registered training provider who is not the employer or an associate of the employer. And the provider must be registered in the area of the training being provided. Here is the definition of registered training provider:

(a) A ‘registered higher education provider’ that is registered with the Tertiary Education Quality and Standards Agency; or

(b) A registered Vocational Education and Training provider (‘registered VET provider’), being a registered body of least one of the following kinds:

• an NVR registered training organisation that is registered with the Australian Skills Quality Authority;

• a registered education and training organisation that is registered with the Victorian Registration and Qualifications Authority; or

• a registered training provider that is registered with the Training Accreditation Council of Western Australia

The following websites can help you clarify if your trainer is registered www.training.gov.au and www.teqsa.gov.au

The boost only applies if the training is provided to employees so does not include contractors. This also means that a sole trader or partners in a partnership will not qualify for the boost on training provided to them personally because they are not employees. If the training is provided in person it must be provided in Australia but it can also be provided online to employees anywhere. This clause is probably to make sure the boost doesn’t become an excuse for an overseas junket. Further, travel, meals and accommodation costs will not qualify for the boost unless they are charged to the employer by the training provider. Books, reference materials and equipment that directly relate to the training, are incidental to the course and included in the fee the employer pays to the training provider would qualify for the boost.

Julia's Blog

Julia's Blog