Drawing the deposit for an investment property from a line of credit or similar account that is also used for other purposes will very quickly lead to none of the interest charged on the deposit being tax deductible. That is probably a reduction of 20% of the interest you can claim each year.

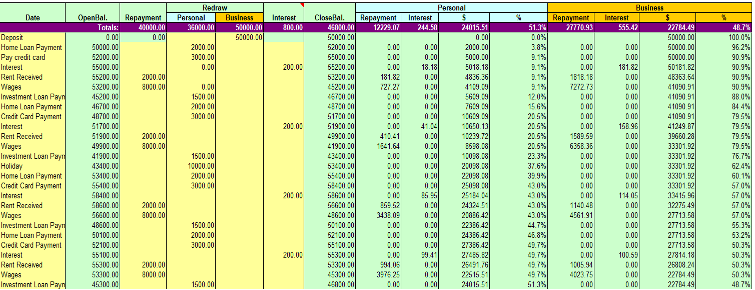

This table shows how in just 4 short months the portion of the interest that is tax deductible goes from 100% down to less than 50%. You are still paying the same amount of interest, you just don’t get a deduction for it.

If you think that your situation is not that bad, put it to the test, you can download this spreadsheet here https://www.bantacs.com.au/shop-2/apportionment-calculator/ Here is a link to the ATO ruling on the matter https://www.ato.gov.au/law/view/pdf/pbr/tr2000-002.pdf

The Rules:

What the borrowed money is used to buy determines whether the interest on the loan is tax deductible. The link between the borrowing and the expenditure is called the nexus. This nexus needs to be very clear. You need to be able to show exactly how the money borrowed was used to purchase an asset that is producing income. For the interest on a loan to be tax deductible it must be a cost of earning taxable income.

Capitalised interest (borrowing to make interest repayments) is not deductible if it is part of a scheme to increase a tax deduction. It is ok if you are caught in hard times and that is the only way you can afford the repayments.

Interest on the deposit for a rental property and the eventual loan for the rental property is tax deductible. Interest on borrowings for stamp duty and borrowings for the portion of Lenders Mortgage Insurance (LMI) that relates to deductible loans is also tax deductible.

It does not matter where the loan is secured. Deductibility of interest is determined by the use the borrowed funds are put to.

The nexus can be broken by putting the redrawn funds into an offset account. There must be a clear path from the loan to the deductible expense, no detours.

LMI needs to be apportioned according to the deductibility of the loan that it applies to. It would be nice if the bank apportioned the LMI and took it out of each loan. Unfortunately, they are likely to take it from just one loan, this could lead to a mixed purpose loan if the family home is in the refinance mix because the family home loan’s share of LMI is not tax deductible nor is the interest on the borrowings to pay it. Some banks organise their LMI to only apply to some loans. For example, don’t refinance the current private residence loan. Instead, just take security over the private residence for another loan to buy an investment property. Using the primary residence as security will keep the loans for each property separate and allow you show that only the investment property loans triggers LMI, so all the LMI will be tax deductible. But if the LMI is calculated on the total loan balance including what is outstanding on the private home loan then the non deductible portion of the LMI has to be accounted for separately.

The ATO leave alone a strategy of paying off your home faster than your investment property providing it does not involve increasing the deductible debt. For example, your home loan could be principle and interest and the investment loan interest only, freeing up cash to pay off your home loan sooner. Careful here, it may not be worth it if the bank is going to charge you a higher interest rate for interest only.

With a loan that has a mixture of private and deductible borrowings the interest and repayments must apportion according to the ratio of deductible and private use. This can mean a loan starts out fully deductible but if there are any private drawings from the loan you will very quickly lose that 100% deductibility. Not just because of the non deductible redraw but because repayments no matter what the source cannot pay off the non deductible deb any faster than the deductible debt, as shown in the table above. This very quickly pays off the deductible portion of the loan because that is the bigger portion.

Unmixing a Mixed Purpose Loan:

Refer paragraph 18 of TR 2000/2. As this is a concession by the ATO it is best not to deviate from the exact instructions given. Namely, set up two new loans one for the balance outstanding that is private and one for the balance that is outstanding for the deductible borrowings and on the same day draw the funds from both these new loans to pay off the old loan. Then of course concentrate your spare cash on paying down the non deductible loan.

The only other way a loan can be unmixed is if the asset purchased with the borrowings is sold and that portion of the debt is repaid.

Julia's Blog

Julia's Blog