This blog has been inspired by the terrible tax outcomes I have seen for people selling a basic rental they purchased as a home and land package or whose home is on 5 acres or more, all the way through to farms. The latest is a vendor who sold his cattle property under a normal residential contract with no margin scheme or farmland clause. The conveyancer’s excuse was, oh he didn’t tell us he was registered for GST. This mistake cost the vendor just short of $100,000 in GST and the purchaser was elated because they could claim that back from the ATO without having to pay any more than what they thought was going to be the GST exclusive price. From this vendor’s experience it looks like the onus is on the seller to look out for themselves. Here are the traps and some clever tricks.

GST Clauses

In most cases you are going to get the same price for the property whether you have to pay GST to the ATO or not, so it is absolutely critical that you have a solicitor that is very experienced in this area. I know of a situation where a firm claiming to be property specialist locked a vendor into registering for GST and for that reason and only that reason, they were liable to pay $400,000 to the ATO. Simply, because the contract said the vendor was registered for GST. GST law did not require that vendor to be registered but once they were then they had to pay GST of 1/11th of the sale proceeds. So please read and understand this blog, it may be the most lucrative 20 minutes you have ever spent, bare with me, maybe read it twice or at least give this blog to your solicitor to read.

Some conveyancers are telling rental property owners that they must register for and pay GST when they sell a house and land package that they have only held as a rental, for less than 5 years. There is a carve out for GST registered entities that hold a brand-new property as a rental. After 5 years of continuous rental it is no longer considered a brand new property so GST does not apply. As residential rents are not subject to GST most property investors are not registered for GST. If you are not required to be registered then you don’t have to be registered just because you decide to sell your investment property and if you are not registered you simply do not have to charge GST. The full argument to present to your conveyancer can be found in this blog https://bantacs.com.au/Jblog/do-not-let-your-conveyancer-talk-you-into-registering-for-gst/#more-948

The key point is the $75,000 turnover test as to when you are required to register for GST does not include residential rents and sale of capital assets. As you built the rental property to hold as a capital asset its sale value is not turnover, not included in the test so does not push you to be required to register for GST. Unfortunately, with tax law, the onus of proof rests with the taxpayer so you are going to have to convince the ATO you did not build the house with the intention of selling. The longer you hold it as a rental property the easier it will be to convince them. Ideally, hold the property for the whole 5 years but if something pushes you to sell it sooner then that may amount to a change of circumstances that can explain why you changed you mind from investment to sell but supports the fact you originally intended to hold as a long-term investment.

Second hand houses are only ever subject to GST if they have been substantially renovated but with all other properties you need to be alert. Vacant land or land with a brand-new house on it or a commercial property are all subject to GST if the seller is registered for GST or required to be registered for GST. Now there is your first clever trick don’t register or de register if you are registered. As long as your turnover is less than $75,000 you have this option.

Don’t Register

Look to the entity that owns the land, are they in business? Consider that if the land is owned by two people, do they use it in a business together? Possibly the case if the land is being used to produce income. On the other hand, if one of the owners is otherwise registered for GST it does not count, it is a question of whether the owners of the land are jointly in receipt of income i.e., in business as a partnership and that partnership entity is registered for GST. If not, there is absolutely no reason to register for GST and fall into the trap. The sale of the property is the sale of a capital asset not the receipt of income (part of turnover). That is assuming you are not flipping the property (buying with the immediate intention of reselling at a profit). There is no avoiding being registered for GST if you are building spec homes.

What if the owner or joint owners together do receive business income whether through the land or some other enterprise. By enterprise I mean a business entity that is the same as the ownership of the land i.e. a partnership of all the owners or if only owned by one person that person is also running a business in their personal name. This is where the trouble starts. Income from the sale of goods or services is the business turnover, if the business turnover exceeds $75,000 then the business must register for GST. Section 23-5 that states if the annual turnover of supplies you make in the normal course of your enterprise, exceed $75,000 you must register for GST. Section 185-25 excludes from the calculation of annual turnover the supply of a capital asset. Section 118-15 excludes from annual turnover input taxed supplies so any domestic, residential rents received are not included in annual turnover.

If you don’t need to register whatever you do don’t register and remember that the value of the property is not turnover. If you are already registered then what is there to stop you deregistering? You may have to pay back some GST input credits on recent purchases, but that is bound to be less than the GST on the property.

De-Register

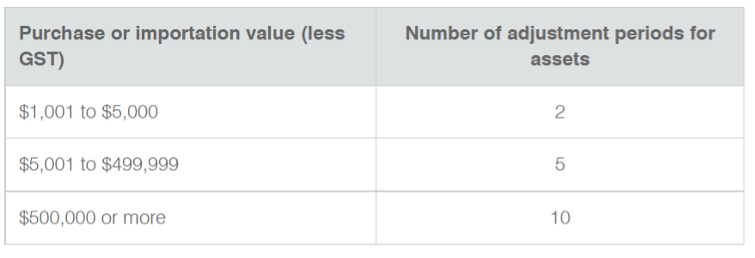

If you are already registered get advice on the consequences of de-registering, from your Accountant. Obviously, the first thing you have to do is get your turnover under $75,000. The next problem is that some of the GST input credits you have been claiming might have to be repaid, the period of claw back is determined by the value of the individual invoice. The number of adjustment periods refers to the number of years after the first 30th June from the date of the invoice in question. You only have to examine invoices with a value of greater than $1,000.

Crunch the numbers with your Accountant and consider the cost benefits of paying back some of your GST input credits on other items to save paying GST on the sale of the property.

If the adjustment period has not expired and you purchased the property under a going concern clause, even though you didn’t technically claim the GST back you may still have to pay back the notional GST saving. This is an area of the law where the legislation is not clear and it has not been tested in the courts, so there is some doubt. If you are going to deregister for GST before the adjustment period has expired, it would be wise to obtain a private ruling on whether you have to pay back the notional GST. You might like to quote

PBR 54936 which is a private ruling that is only binding on that taxpayer but the ATO said there was no balancing adjustment on de registration yet there is an ATO handbook that says there is an adjustment to be made at de registration for the notional GST saved under a going concern clause. Even if your ruling is not successful paying back the GST on the purchase price compared with paying GST on the selling price probably still has benefits, well worth a discussion with your Accountant before you sign a contract.

Now if you are not registered or required to be registered for GST you still have to make sure that your contract does not imply you are registered for GST. It should not contain a farmland clause, margin scheme clause or going concern clause. Obviously, it should not state that the seller is registered for GST and you should not provide a Tax Invoice.

If you are registered for GST when you sell the property then you need to be very familiar with the following clauses to make sure they work for you, not against you.

Margin Scheme

Generally you can use the margin scheme if you were not entitled to GST input credits on the property’s purchase but not if the lack of GST input credits was because of a going concern or farmland clause. For more details on when the margin scheme can be used go to https://www.ato.gov.au/business/gst/in-detail/your-industry/property/gst-and-the-margin-scheme/?page=2#Whenyoucantusethemarginscheme

The margin is the difference between the price you paid and the selling price. A margin scheme clause means you only pay GST on the margin, not the full sale proceeds. As a consequence the buyer is not entitled to any GST input credit back from the ATO. If the buyer is registered for GST and entitled to claim the credit back, then it is better to charge the GST and adjust the price accordingly before you sign the contract. The catch with this is the stamp duty will be on the GST inclusive price so it may be worth looking at some of the following options to just keep the contract completely free of GST.

Going Concern Clause

This requires you to supply the buyer with all things necessary to continue the business and you to continue to operate the business up to the day of sale. If your business is just leasing a commercial property then signing over the lease will be enough. If you are the tenant as well as the owner, you have a problem in that you can’t sign a lease with yourself so you have no lease to sign over. For more details on all things necessary refer GSTR 2002/5 https://www.ato.gov.au/law/view/document?LocID=%22GST%2FGSTR20025%2FNAT%2FATO%22&PiT=20080514000001

To use a going concern clause both the buyer and seller must be registered for GST. A going concern clause means the seller does not have to pay GST to the ATO and the buyer is not entitled to claim the amount back. The advantage of a going concern clause is it keeps the price down so less borrowings and less stamp duty. The catch for the buyer with a going concern clause is if they stop using it in a business then they may have to pay GST of 1/10th of the purchase price to the ATO unless the adjustment periods discussed above have expired.

Farmland Exemption

This is very useful, it is a complete exemption from GST on the sale of land that has been used for farming by someone for at least the last 5 years providing the buyer intends to continue, initially at least, to use the property as farmland. The bonus here is if, after a while the buyer stops using the property as farmland they do not have to pay back any GST. The buyer does not have to be registered for GST to buy a property under a farmland exemption.

GST Withholding

If the property is a new residential house or land, including farmland and commercial land, where the zoning allows a house to be build, the purchaser is required to withhold a portion of the sale proceeds and send it to the ATO as GST, giving you a credit you can claim back in your next BAS. This is fine if you are registered for GST, though make sure there is enough of the sale proceeds left to keep the bank happy. Note if you use a farmland or going concern clause GST withholding does not apply. If you are using a margin scheme clause it will reduce the amount of GST withheld down to 7% of the total sale proceeds.

The catch is if you are not registered for GST and this money is withheld you have a problem with getting it back and one thing for certain the ATO will be looking closely at why you think you should not be registered. This puts the buyer and seller at opposite poles because if the buyer doesn’t withhold and the ATO later decides they should have, the buyer then has to pay the amount to the ATO anyway, over and above the purchase price. So you should expect the buyer to need some certainty. Your argument is going to be that you are selling are capital asset so not required to be registered for GST as stated at the start.

The ATO ruling on this is LCR 2018/4. You are relying on paragraph 15:

15. A purchaser only has a GST withholding obligation when a vendor is making a taxable supply. A vendor will not be making a taxable supply in situations including:

- where the vendor is not registered for GST and not required to be registered for GST as the sale is not in the course or furtherance of an enterprise

- the sale of residential premises is input taxed because they are not ‘new residential premises’ (refer to paragraph 18 of this Ruling), or

- the sale is a GST-free supply, for example as part of a GST-free supply of a going concern or GST-free farmland.

The seller needs to give the buyer a statement to that effect. It is up to the buyer if they accept that. It might be prudent to get an ATO ruling before putting the property on the market. Waiting for one after you find a fussy buyer might take too long and the contract may fall over.

The thing to watch out for in the contract is to make sure the box is ticked correctly to say that this is not the sale of a property that is subject to GST. The wording varies from state to state and it is a bit of a fine line because it really is the type of property GST applies to but simply because you are not registered, GST does not apply.

For a more detailed blog examining the ATO’s ruling on this and when they think the buyer should withhold go to https://bantacs.com.au/Jblog/small-developments/#more-248

Income Tax or CGT

Income tax at your marginal tax rate will apply if you buy a property with the primary intention of selling it at a profit. Otherwise, CGT applies and if you keep the property for over a year this means a 50% discount on the amount of capital gain that is taxed. So, it is very important to be able to prove your thoughts because the way tax law works the onus of proof is on you. The first thing the ATO will do is ask the bank what you told them when you applied for the loan. There are several cases where the ATO has been successful in arguing, many years later, that the taxpayer’s intention when they purchased the property was to sell at a profit so no 50% CGT discount. Here is a webinar covering one such case:

More discussions on proving your thoughts in this blog, where the AAT did say it was enough that one of the intentions was to sell the land at a profit. https://bantacs.com.au/Jblog/fully-taxable-profit-or-50-cgt-discount/#more-810

Once the ATO decides that you did purchase land or built a house with the primary intention of reselling it at a profit then the sale counts towards your turnover for GST purposes, you will be required to register, so GST will apply.

If the property has been used in a business for 7.5 years or half the time you owned it there is another 50% CGT concession available, called the active asset concession. Your business assets have to be worth less than $6mil or your turnover under $2mil. So this could bring your taxable capital gain down to 25%. But there is more! You can roll the remainder into another active asset and delay paying tax on it or you can use the retirement exemption. The retirement exemption allows each owner up to $500,000 tax free in their lifetime. The only catch is if they are under 55 years of age they must put the money into super, it won’t get taxed going into the super fund either.

Here is an example of how this works on a $2mil capital gain:

| Gross Capital Gain | $2,000,000 |

| Less 50% CGT Discount | $1,000,000 |

| $1,000,000 | |

| Less 50% Active Asset Disc | $500,000 |

| $500,000 | |

| Retirement Exemption | $500,000 |

| Tax | $0 |

Alternatively, if you are selling in connection with your retirement and you have owned the property for 15 or more years, using it in a business for at least 7.5 years and your business assets are under $6mil or turnover under $2mil you get the whole capital gain, tax free.

Main Residence Exemption

If you home is on more than 2 hectares (5 acres) then part of the land is exposed to CGT because the maximum area your main residence exemption can cover is 2 hectares. Further, if an area is being used to produce income it cannot be covered by your main residence exemption even if the block is under 2 hectares.

So, if you are going to use part of the property to produce income make sure it is not just passive income such as agistment or rental. Make it a business and make sure you declare the income in your tax return even if it is caught by the non-commercial loss rules which will mean it can’t be offset against your other income, just carried forward each year in your tax return. Just as long as you can show it was used in a business you may get to qualify for the small business concessions discussed above.

If your problem is just that your property is larger than 2 hectares, consider that you are allowed to choose the area exposed to CGT (not the land under the house of course) so pick the area with the lowest capital gain i.e., an area you may have spent a lot of money on such as a driveway, so the cost base is higher. Or an area that has not gone up in value at all because it was and always will be worthless, such as swamp land.

Good record keeping will reduce the capital gain. This spreadsheet, especially designed for homes on more than 2 hectares can help work out the best strategy for your block and help you keep the right records to keep the CGT to a minimum.

https://www.bantacs.com.au/shop-2/cgt-record-keeping-and-tricks-for-homes-on-more-than-2-hectares/

For an example of how to divide up the property https://bantacs.com.au/Jblog/apportionment-when-your-home-is-on-more-than-2-hectares/#more-1218

Land Tax

This varies from state to state. Consider that if a property is used as farmland or a caravan park then it is likely to qualify for land tax concessions as well as the small business concession for any CGT on sale.

ATO Clearance Certificate

One final thing to consider if you are selling or buying a property worth more than $750,000. The seller must provide the buyer with an ATO clearance certificate stating they are an Australian resident otherwise the buyer must withhold 12.5% of the purchase price and send it to the ATO. If the buyer does not, the ATO can ask them to pay the 12.5% out of their own pocket, over and above the purchase price.

If you are not an Australian resident, then you will need to lodge a tax return to claim the 12.5% back. If the withholding is going to create a problem such as the bank will not release the mortgage unless they receive the whole sale proceeds, you can apply to the ATO to reduce the withholding amount.

Please note that this blog is not intended to give you the skills you need to do all this yourself. Just enough understanding to recognise a professional that is aware of these issues and to help you negotiate. You should seek professional advice before you sign the contract, not much can be done to fix any problems after you have signed.

Julia's Blog

Julia's Blog