This blog is directed at owners of strata units that are used to produce income. Note this includes owner occupiers where there is income earned by the body corporate from common property. It is also relevant to committee members who are concerned about the body corporate’s tax obligations.

Tax Deduction for Body Corporate Fees

Body corporate fees for an administration fund or sinking fund are tax deductible if your unit is being used to produce income. It is the special purpose sinking funds or a special purpose levy where things get complicated.

The special purpose needs to be examined just like expenditure on works in a free standing rental property. For example, is it an improvement beyond the condition the property was in when you purchased it? TR 97/23 https://www.ato.gov.au/law/view/document?DocID=TXR/TR9723/NAT/ATO/00001 thoroughly covers this issue. If the special expenditure cannot be considered a repair then the levy is not tax deductible but can increase your cost base. Further, you will be entitled to claim division 43 building depreciation on the expenditure once the body corporate have undertaken the work.

An example of a deductible special levy would be funds raised to undertake storm damage repairs. This would not have been forecast in the sinking fund , if not covered by insurance, then very likely a special levy will have to be raised. Providing the damage repair does not improve the building ie like is replace with like then this levy would be tax deductible to owners, who owned their unit before the storm and are using their unit to produce income in the financial year the levy is paid. If the unit is used to produce income for only part of the year then the levy will need to be apportioned on the ratio of income producing to private use for that year.

An example of a non deductible special levy would be funds raised to replace flammable cladding that does not need repairing. It is just being replaced for safety purposes. This levy can increase the cost base of the unit and will qualify to be depreciated over 40 years at 2.5% under Div 43 special building write off. Note that future owners of the unit will be entitled to continue the Div 43 write off if they use the unit to produce income.

The purpose to which the funds are put would normally be available in the committee minutes. The ATO can also access these minutes.

Rent Received for Common Property

To be clear, common property is the land and buildings including equipment permanently attached to them, that all lot owners share. It does not include equipment such as gym equipment, washing machines etc. The common property might be rented out for events or permanently such as the roof top for a Telstra tower. This rental income is taxable in the hands of the unit owners not the body corporate. Reference TR 2015/3 paragraph 41. All building depreciation including common property is deductible to the unit owners, not the body corporate, though of course it will only be tax deductible if the area has been used to produce income.

It is important to note that even if your unit is simply your home, receiving rental income from common property is taxable and will create an apportionment issue with your CGT main residence exemption. If the property has always been covered by your main residence exemption, the first time the body corporate earn any money from common property your cost base will be reset to market value at that date. From that point onwards you will need to keep capital gains tax records on your unit, because a small portion of the gain on its sale will be subject to CGT. The way the formula works you need to calculate the whole gain first then apportion between the area used for private and the area used to produce income. This spreadsheet shows you how to keep the appropriate records https://www.bantacs.com.au/shop-2/protecting-your-home-from-cgt/ It is not just the problem of keeping records, the fact that you home is being used to produce income at your date of death will prevent the resetting of your cost base to market value at date of death. So, your heirs will need these records too.

Income Tax on Body Corporate

Body corporates are taxed as companies and can technically distribute franking credits from tax paid but it is unusual for dividends to be paid to lot owners. Even though for GST purposes a body corporate may be considered a not for profit, it will not be taxed as a not for profit.

Body corporates do not have to pay income tax on levies received from owners because these levies are considered mutual income, of course the expenses paid for by those levies are not tax deductible either. Interest charged for late payment of body corporate fees is also considered mutual income. Fees charged to unit owners for access to body corporate records are also mutual income. Likewise hire fees received from unit owners for use of equipment owned by the body corporate are mutual income but the same fees received from the public would be taxable in the hands of the body corporate.

Rent received from leasing common property is taxable but in the hands of the unit owners, not the body corporate. Examples of body corporate income that would be subject to income tax in the hands of the body corporate:

- Penalties imposed upon unit owners or occupiers for breaches of by laws.

- Fees charged to non owners (ie prospective buyers) for access to body corporate records or hire of equipment such as washing machines.

- Interest earned when body corporate funds are invested.

GST

A body corporate may be considered a not for profit enterprise, for GST purposes, if it is not distributing any profits such as interest or income from rental activities, to the lot owners. Accordingly, it does not have to register for GST until its expected annual turnover exceeds $150,000. If the body corporate is not considered a not for profit it will need to register for GST when turnover exceeds $75,000. This turnover tests includes levies to lot owners so most large buildings would be subject to GST.

It is worth considering when setting budgets for levies whether some expenses can be amortised over a longer period to not trigger the $150,000 threshold. The test is looking at the current month and a prediction of the next 11 months.

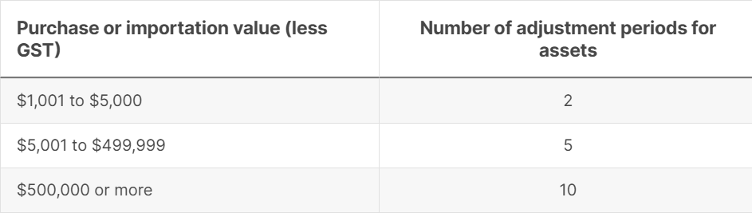

It may be the case that in one year unusually high levies trigger GST registration. It might not be so bad to be registered for this period as there will be GST input credits for the expenditure. It is just the burden of the paper work that will make you consider de registering as soon as the turnover comes back under the $150,000 threshold. That needs to be weighed up against the GST input credits that will have to be paid back on de registration if the adjustment period for that invoice has not expired. GST adjustment periods depend on the size of the invoice.

The adjustment periods are years and the start of the period is the first 1st July after the invoice date.

Owners cannot claim an input credit for the GST charged in body corporate levies if the property is residential. Though they can claim the full GST inclusive amount as a tax deduction against income earned if the property is used to produce income. The bottom line is most residential unit owners do not benefit from the body corporate charging GST, because they are not entitled to claim it back. Most of the GST that will be paid on levies will be offset by GST inputs credits when the levies are spent, that would not be available if the body corporate was not registered for GST. But there are increased administration costs.

In most cases the GST charged on levies on commercial premises will just come out in the wash as the tenant or the owner claims the input credit back in their business. With the added advantage that the body corporate can claim GST input credits on expenditure.

Julia's Blog

Julia's Blog