Noel Whittaker explains this beautifully in his easy to read style, in this blog:

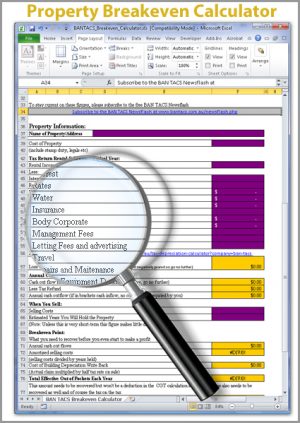

This spreadsheet is designed by CGT guru Julia Hartman to help you keep the right records to minimise the CGT on the property you choose not to cover with your main residence exemption and also allow you to estimate the best property to cover with your main residence exemption. The biggest tax saving tip is good record keeping. This spreadsheet sets it all out in front of you with a facility to link each entry to a scanned document. This is also a brilliant tool to start to get your affairs in order for your executor. The work pays a great hourly rate, not only will it save you CGT but also Accounting fees. Though of course you must get an Accountant to review your work before you lodge the relevant tax return.

It is not too late to start, every single entry you can make will make a difference. The spreadsheet will help you know what is relevant, everything you need to know is clearly on the sheet in front of you. Start by duplicating the spreadsheet, keep a spare template then do a separate spreadsheet for each house that has potential to be covered with your main residence exemption. There is no need to understand complex tax law or high-level spreadsheet functions. The purpose of this spreadsheet is to guide you in what is relevant to record as well as keeping an electronic copy of all your documents. Just a step-by-step process, with plain English instructions.

What about your other assets? If your shareholdings have a dividend reinvestment plan attached, each reinvestment needs to be recorded or CGT will be payable on a gain you didn’t really make. Will your executor be able to get a hold of all this information in the event of your death? Don’t leave the ATO a tip! Before you buy this spreadsheet consider the full package of spreadsheets for all your asset available here http://www.bantacs.com.au/shop-2/getting-your-affairs-in-order-made-simple/ That includes this spreadsheet. The complete set also includes a spreadsheet to include scanned copies of important records such as your will, passwords, birth certificate, periods of time you were a non resident etc.