Australia does not have an inheritance tax as such but watch them rip into your inheritance if it comes from overseas. This blog covers most common scenarios but not all possible circumstances. It is certainly not definitive advice.

Firstly, what is an overseas estate? One that does not have an Australian executor. If just one of the executors is an Australian resident for tax purposes then Australia will grab the estate as a resident for tax purposes. In some circumstances this may not be a bad thing. But of course, the countries of residence of the other executors and the deceased probably want to get in for their cut too.

If the estate is not a resident of Australia for tax purposes, you as a resident of Australia for tax purposes will have a tax responsibility on your inheritance unless you are simply receiving cash that the deceased had at the time of their death.

The tax treatment varies depending on what you actually receive and when you receive it. The explanations below apply to an Australian resident beneficiary of a deceased estate where both the deceased and executor are non-residents of Australia for tax purposes.

The Basics

Cash held at Date of Death (DOD)

Receiving cash held by the deceased at date of death (DOD) will not be taxed in Australia. Though if the amount you receive is more than $10,000 expect the ATO to ask questions so it is important that the executor gives you the details on the original source of any distribution you receive.

Income Earned by the Estate

If it is income (i.e. rent) earned by the estate after death then (baring specific directions from the will) if you are entitled to 25% of the estate then you will be taxed on 25% of this income in Australia. You are taxed on this income in the year you receive it. This is where non resident estates differ from resident estates. In the case of an Australian resident receiving income from a non-resident estate it does not matter if it was income to the estate in a previous year. Section 99B will still catch it as income in the year received by the Australian beneficiary. If the estate has paid any tax on that income then the Australian beneficiary may be entitled to a credit for that tax paid.

Taxable Australian Property (TAP)

This can include interests in businesses and closely held shares but in most cases it refers to Australian Real Estate. As Australia has always had a right to tax this property any capital gain will be calculated starting with the deceased’s cost base. Whether sold by the estate or the beneficiary Australia will always have a right to tax the whole gain. If it is the estate that sells the TAP and pays tax in Australia then that capital gain will not be taxed in the hands of the Australian beneficiary under 99B because Australian tax has already been paid. Some CGT discount could apply for the period of ownership before 8th May 2012 and any period after that date that the owner was an Australian resident i.e. transferred in specie to an Australian beneficiary. Even if the deceased had previously been an Australian resident and previously lived there the main resident concessions can only apply if the deceased died less than 6 years after becoming a non-resident of Australia for tax purposes.

If the TAP is transferred in specie to the Australian resident beneficiary they, instead of the estate will be liable for all of the CGT but there may be some opportunity to offset capital losses and a possibly bigger portion of the 50% CGT discount depending on how long the non-resident beneficiary holds the property.

Gain Made By Estate On Sale of Deceased’s Foreign Assets

This would include real estate located overseas and publicly listed shares etc. Where these assets are sold by the foreign trust for more than their market value on the deceased’s date of death, the distribution from the foreign trust that represents the capital gain is caught by section 99B if received by an Australian resident. Whether the capital gain was made by the estate in the year the Australian beneficiary receives it or a previous year (unlike Australian Deceased Estates) it is still taxable in the hands of the Australian beneficiary. There is an exclusion in section 99B which protects the value of these assets as at date of death referred to as the trust corpus, so tax is limited only to gains arising from date of death. Note that 99B is a statutory income provision – meaning the character of the income is lost – no CGT discount or having capital losses applied to it. For this reason, an Australian beneficiary may benefit from receiving the asset in specie and selling the asset themselves, though there is a lot to consider here including legal advice on whether the asset can be transferred in specie.

When the Australian Beneficiary Receives the Deceased’s Foreign Asset Instead then Later Sells It

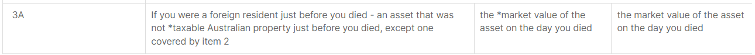

In a strange, possibly unintended twist in the legislation, for the purposes of the CGT discount the Australian beneficiary receiving an asset in specie is deemed to have acquired it on the same date as the deceased, therefore quite likely qualifying for the CGT discount. Under section 128-15 3A, as long as the asset is not Taxable Australian Property the CGT calculation starts with a cost base of the market value at the date of the deceased’s death.

Note the full 50% CGT discount is unlikely to apply because of the time after 8th May 2012 that the asset was owned by a non-resident of Australia, more about that further down. Having the estate transfer a foreign asset in specie to an Australian beneficiary so they can sell it in their name and offset capital losses and have a chance at some CGT discount compared with the estate selling it is worthy of consideration. Though as later explained in detail, as the period of ownership by a non-resident will always erode the 50% CGT discount, consideration should also be given to selling asap and buying a similar asset that will qualify for the full 50% CGT discount.

You will need legal advice as to whether the estate can distribute an asset to you anyway. Don’t fall into the trap of trying to compensate your fellow beneficiaries by topping up any uneven distribution by contributing some money to the estate. If you pay any money towards an asset received from the estate you are deemed to have purchased it from the estate for market value, so you are right back to the scenario of where the estate has sold the asset. Alternative solutions would be to transfer the asset into the names of more than just one beneficiary before it is sold or consider trading other assets with the other beneficiaries to even up the distribution. An agreement between beneficiaries to take various assets in specie, instead of directly according to the will is not considered buying the asset from the estate, just as long as no money changes hands, other than that of the deceased. But you will need legal advice as to whether this can be done within the terms of the will.

The 50% CGT Discount

This only applies if the asset is TAP or has been transferred into the name of an Australian beneficiary before it is sold. If the estate sells the asset and transfers the capital gain to an Australian beneficiary the CGT discount is not available at all, thanks to 99B.

If instead the asset is transferred to the beneficiary and they sell, while the first element of the cost base might be market value at DOD, the acquisition date for the purposes of the 50% CGT discount is considered to be the date acquired by the deceased. This is useful in reaching the 12 month mark to qualify for the CGT discount, but the important point here is that since 8th May 2012 non-residents are not entitled to the 50% CGT discount. This period of ownership by the deceased is considered in determining the amount of CGT discount available to the Australian resident beneficiary.

Section 115-105 dictates how the 50% CGT discount is applied when for part of the time an asset was owned by a non-resident. This section goes right back to the date the deceased acquired the asset, looking at every day between then and the sale of the asset. For days pre 8th May 2012 the 50% CGT discount can apply. After that date the discount can only apply if it was owned by an Australian resident.

The key points for the beneficiary are to obtain the date of purchase by the deceased and their residency during the whole period of their ownership.

Example to Draw Out Some of the Peculiarities

For example, let’s say the non-resident deceased purchased a foreign property for $100,000 in January 2000 and they died in January 2020 when the property was worth $480,000. The estate sold the property in January 2022 for $500,000 (after deducting selling costs) and held onto the proceeds until January 2023 to make sure all of the estate’s liabilities were met. The beneficiary is an Australian resident entitled to 50% of the estate. In the end the other assets were enough to cover the liabilities, so the 2023 distribution was made up of the sale proceeds of the foreign property i.e. $250,000 to the Australian beneficiary.

Unlike the situation with Australian estates, section 99B will capture the capital gain made by the estate in the 2021-2022 year as normal foreign income of the Australian beneficiary in the 2022-2023 year when the cash is received. Though the gain won’t be much because the first element of the cost base will be the $480,000 market value at DOD possibly plus some holding costs let’s assume $2,000. The capital gain will be $500,000 – $482,000 = $18,000 x 50% to the Australian beneficiary = $9,000.

Section 99B does not allow this to be treated as a capital gain i.e. no offsetting of losses or CGT discount it is just normal foreign income taxed at marginal rates plus Medicare.

Alternatively, consider all of the above dates and amounts except that before the sale of the property it was transferred in June 2021 into the name of the two beneficiaries. So, half the property was owned by an Australian resident, and it was the beneficiaries who sold it in January 2022. The gain would then apply to the 2022 tax return of the Australian beneficiary. The gain would be the same $9,000 but it is a capital gain in the beneficiary’s tax return not just normal foreign income from a trust. As the property had been owned by an Australian resident some CGT discount could apply.

The interesting twist is the calculation of the portion of the 50% CGT discount that will apply. Even though the cost base is reset to market value at DOD the acquisition date is not for the purposes of apportioning the discount, this date goes right back to when the deceased acquired the asset.

From 8th May 2012 non-residents are not entitled to the 50% CGT discount. Section 115-105 ITAA 1997 looks at the whole period since the deceased bought the property back in January 2000. The discount is apportioned on days that it applies verses days it does not. So, for an example just using months. The discount would apply from January 2000 to May 2012, 148 months and from when it became the property of an Australian resident from DOD January 2020 to sale in January 2022, 24 months. That is 170 months out of 264 months which is 64% of the 50% CGT discount = 32% discount. A 32% CGT discount will mean that only $6,120 of the $9,000 will be taxable. This discount is only possible because the property was first transferred to the beneficiary. Furthermore, if the Australian beneficiary had capital losses they could further reduce the $9,000 before applying the discount. Note there needs to be no concern about whether the property was owned by the beneficiary for more than 12 months, because the deceased, the estate and the Australian beneficiary, combined had owned it for more than 12 months.

Of course, the more valuable the asset the more relevant the CGT discount becomes.

Tax Tip – If there are no negative consequences in the foreign country and legal advice says that you can, it is better to transfer the property into the Australian beneficiary’s name before it is sold so that capital loss can be offset and there is some discount on the capital gain.

Tax Trap – If the Australian beneficiary holds onto the asset for considerable time they are still never going to qualify for the full 50% CGT discount because of the way the formula works so it may well be better to sell the asset asap after DOD and buy a similar one so that all of the capital gain going forward qualifies for the 50% CGT discount.

Looking at Particular Assets

The Deceased’s Home

The deceased could only cover an Australian property with their main residence exemption if they died within 6 years of becoming a non-resident, otherwise there is no pro rata.

If the property is located in Australia and the 6 years has expired then this dwelling is just treated like any other TAP, see below. None of the main resident concessions are available, including the 2 years to sell or concessions for life tenancy. And of course, as this is TAP, there is no reset at DOD, so the calculation goes back to what the deceased originally paid for the property. On the upside when the Australian beneficiary receives the sale proceeds, as the estate has paid some Australian tax no tax is payable by the beneficiary as 99B does not apply. If the Australian beneficiary has the house transferred to them in specie, there are pros and cons. Still taxed right back to when the deceased purchased the property and no main residence exemption but at least CGT losses can be offset and maybe some CGT discount could apply but of course it is now the Australian beneficiary who will pay all the Australian tax not the estate.

Assuming the deceased’s home is not located in Australia, then it is just a foreign asset. If the foreign property is transferred to the beneficiary in-specie, the cost base is the market value on DOD as per section 128-15 3A. Remember that for the purposes of the CGT discount you use the deceased’s original acquisition date. If the foreign asset is sold by the estate and you as the Australian resident beneficiary receive the sale proceeds then the portion of the proceeds which is the capital gain from DOD to date of sale is taxed under Section 99B. The market value of the property on DOD is protected by the exclusion clause in Section 99B (2)(a).

Gain Made By Estate on Sale of Deceased’s Taxable Australian Property (TAP)

Australia always had the right to tax this property, so the CGT calculation goes back to the deceased’s cost base. There would not be any main residence exemption on this property because the deceased was a non-resident. Though if they died within 6 years of becoming a non-resident Australia for tax purposes there may be the opportunity for the main residence concessions. of

Who pays the tax on the sale depends on who owned the property when it was sold. Non-residents (i.e. the estate) are generally not entitled to the 50% CGT discount though there are some concessions for properties purchased before 8th May 2012, up to that date, see the example above.

If it was still in the name of the estate when sold then the estate would have to pay tax in Australia on the capital gain starting with the deceased’s cost base but then as the property had already been taxed in Australia, you as the Australian resident beneficiary could receive the sale proceeds completely free of tax just like cash the deceased held at DOD, reference section 99B(2)(c)(ii).

If the deceased acquired this Australian property before 19th September 1985 then the cost base would be the market value at the date of death.

If the property is transferred to you, the Australian resident beneficiary before it is sold then there is a rollover that means there is no CGT payable until you sell the property.

In the case of an Australian property acquired by the deceased after 19th September 1985 your cost base goes back to the deceased’s cost base. When you sell the property you will effectively have to then pay the deceased’s CGT. You will be able to offset any capital losses you have. When applying the CGT discount to this capital gain, consider the time it was owned by a non-resident after 8th May 2012 as not qualifying for the discount. If you think about the way the formula works that loss of some discount is going to follow you the whole time you own this property. If you are considering a long term hold, if it was not for stamp duty and selling costs you would be better off selling the property and buying a similar one so that you get the full CGT discount going forward.

Publicly Listed Shares

Listed shares and traded funds will be considered foreign assets because they were owned by a deceased foreign resident. This is even the case when the shares are listed on the Australian stock exchange. The cost base for these shares for Australian tax purposes is the market value at the DOD. As discussed above the acquisition date for the purposes of the CGT discount will be the date they were acquired by the deceased. The percentage of the discount will be reduced to all for the period after 8th May 2012 when the shares or units were owned by a non-resident.

The trap is if the shares are sold by the estate there is no chance of a CGT discount at all because the gain will be taxed as normal income under 99B when received by the Australian beneficiary. This also means that other capital losses cannot be offset against the gain. Whereas if the shares or units were transferred to the Australian beneficiary and they sold they would be entitled to some CGT discount and to offset any other capital losses they may have.

If the Australian beneficiary is considering a long term hold, with transaction costs on shares being low, it is worth considering selling off the parcel that was inherited and buying them back. This way the 50% CGT discount for the ongoing period of ownership is not hindered by the non-resident days the shares were owned. The wash sale is unlikely to trigger CGT if done soon after DOD as there is unlikely to be any gain on the market value at DOD.

Death Benefit etc from a Non Resident Superannuation or Pension Fund

The tax treatment of these payments varies depending on how the deceased acquired the interest and the type of fund that is making the payment. There is no alternative if you receive a payment from a non-resident retirement fund than to apply to the ATO for a ruling on your particular circumstances.

Receive Cash

The tax treatment all depends on where the cash came from. If it was simply money the deceased had when they died then there are no tax consequences in receiving this money. Nevertheless, the ATO will send you a please explain when any large sums i.e. over $10,000 are received from overseas.

On the other hand, if that cash is the proceeds from the sale of an asset of the deceased’s then if the asset was TAP or was sold for more than the market value at DOD there will be tax consequences for you under Section 99B. You need to make sure the executor gives you all the details on the source of the funds you have received.

As a resident of Australia for tax purposes, Australia is entitled to tax your worldwide income including distributions from trusts. The catch is that Australia gets to tax the distribution even if you receive the cash many years after the asset is sold.

This is not to be confused with an Australian deceased estate which pays the tax on any income and capital gains until the beneficiaries become presently entitled. Income and gains before that point never touch the beneficiaries tax return.

It is not that easy when the estate is a non-resident. Australia is just looking at the source of the cash you receive. If that source was the sale of an asset then regardless of how long ago (of course limited to sales after the deceased’s death) you need to work out your share of the distribution that relates to income and capital gains arising since the deceased’s death on that asset and pay the tax in Australia.

Foreign Tax Credits

If you end up paying tax in Australia on a distribution from a non-resident estate you may be entitled to a foreign tax credit for any tax paid overseas by the estate on income or capital gains that is eventually distributed to you. But it must be a similar tax. So for example you are not entitled to a foreign tax credit for inheritance tax paid by the estate but if the estate paid capital gains tax or income tax on a revenue stream and distributed that money to you, you may be entitled to claim a foreign tax credit against any tax you have had to pay in Australia, if Australia has a double tax agreement with the country of which the estate is a resident.

Conclusion

Each asset of the estate should be examined for the best tax outcomes, if you have a choice. It is important to seek legal advice if you are considering an in specie distribution and of course it is important to get tax advice on the consequences of your options. Further, it is important that you get all the information you need from the executor. There should be a document listing the value of the assets at DOD but if you are receiving any assets in specie you will need to know when the deceased purchased them and the deceased’s residency history during ownership. If there is TAP you will also need to know the date acquired by the deceased, periods of residency of Australia and the price paid plus any other items relevant to the cost base.

Depending on the competency of the Executor it may be necessary to obtain advice about the tax laws of the country of residence of the estate. This is best done through one of the big accountancy firms such as BDO as they will have offices in that country to consult with.

This blog should be of particular interest to first generation Australians so please pass it around. If it has got you thinking about what if any CGT records you or your parents etc should be keeping consider investing in our Getting Your Affairs in Order Spreadsheet. https://www.bantacs.com.au/shop-2/getting-your-affairs-in-order-made-simple/

Julia's Blog

Julia's Blog