On 30th June next year investment property owners are going to be in for quite a shock when they open their land tax bill. Many people will be receiving one for the first time. Previously, land tax would not have applied to them because the value of their Queensland property was below the threshold but now the Queensland government are including the value of properties Australia wide.

The old land tax trick, used to be not to buy too many properties in one state so you could stay under the land tax threshold. Just move onto another state when you get close. Well Queensland is no longer having a bar of that, and it affects all the properties you own, other than your own home. When you buy your next property there are strategies you can put into place but for existing properties you are caught.

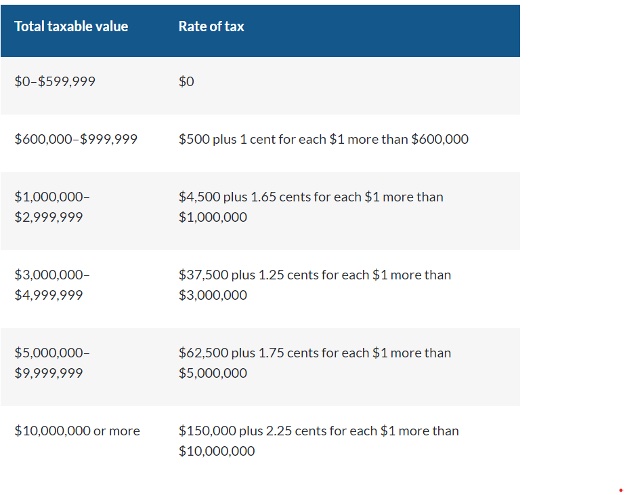

Each individual in Queensland gets a $600,000 tax free threshold before they pay land tax. Companies, trusts and SMSFs get a $350,000 threshold. So, until now if you had 3 properties, one in each of the eastern mainland states with a land value of $500,000 Queensland would only look at the Queensland property land value and say well you are under the threshold of $600,000 so no land tax at all. Now it says if you have $1.5 million in land value across Australia which is over the threshold, so land tax applies. First, they calculate what land tax would apply if all those properties were in Queensland and then apportion the bill pro rata for the land value on property in Queensland. That is, in this example 1/3rd of the bill. But when they calculate your land tax, they also use the properties in other states to decide the tax bracket, taking you into the 1.65% bracket. The Queensland tax rates for individuals are as follows (note rates are higher for non-residents):

The calculation for $1.5 million in land value, Australia wide, would be $4,500 + ($500,000 x 1.65%) = $12,750 then divide by 3 for the Queensland property = $4,250 every year. That is a big jump from zero.

Future purchases can be bought in a different name or a trust, but existing purchases are stuck with this unless they want to pay the stamp duty to change the owner of the Queensland property to a person or entity that does not own property in other states. This change will make rental properties in Queensland very unattractive to anyone who has a property in another state. It may well reduce the rental pool, but it could also bring down property prices as landlords will abandon the state. Quite a gamble by the state government but they are more likely than not going to upset people who don’t get to vote for them anyway. In fact, other states may admire this move so much they may follow suite.

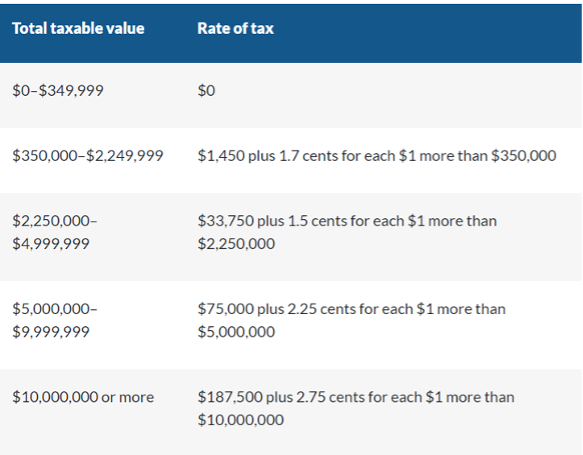

So, what happens if you move your Queensland property into a trust or if you are thinking of buying in Queensland, in a trust. In the latter case, you were going to be up for stamp duty anyway. In the case of an existing property, you need to weigh up the land tax cost compared with the transfer stamp duty. You are unlikely to consider buying in a company because they do not qualify for the 50% CGT discount and a SMSF is costly to run for just one property, expensive to borrow and cannot buy a property off a member unless it is used in the members business. So, except for unusual circumstances, a trust it is. Here is the land tax threshold and rates for trusts (same for companies and SMSFS):

The land tax on a property with $500,000 in land value held in a trust that owns no other property would be $1450 + ($150,000 x 1.7%) = $4,000 That is a $250 improvement every year but probably not worth the cost of running the trust.

On the other hand, if you have $2 million in land value Australia wide, in your name but only $350,000 of that is in Queensland then your Queensland land tax bill will be $4,500 + (1,000,000 x 1.65%) = $21,000 / 2,000,000 x 350,000 = $3,675. Whereas holding the Queensland property in a trust would mean no land tax at all.

So, it is sometimes worth considering buying a property in a trust. Each trust can get its own $350,000 land tax threshold except in the case where the trusts have the same trustee and same beneficiaries. If you are looking to hold a different property in each trust you will need a different trustee. This can be an individual and still the individual’s personal property holdings are not counted with the trust’s for threshold purposes. The catch with an individual trustee is that the asset protection is not as good. Setting up multiple companies so that the trusts all have their own trustee might cost a couple of thousand dollars each at the start but after than it should be under $500 for the annual return and registered office fees.

Certainly not a one size fits all and another important reason to speak with your Accountant before you sign a contract to buy a property, in any state.

If the new land tax rates make your property uneconomical and you decide to sell, it is important to do so before 30th June 2023.

I bet a few readers are wondering how the Queensland government is going to find out what properties they own in other states. Well, I am sure they have ways and means but strangely enough they require you to inform them!?!

From 30th June 2023 you are required to set up a QRO Online account and complete the declaration, including land description, value and percentage of ownership within 30 days of receiving a land tax assessment notice or before 31st October, whichever comes first.

Julia's Blog

Julia's Blog