Exciting job opportunities for travelling workers from WorkAboutAustralia

WorkAbout Australia Club members receive a weekly newsletter outlining the exciting job opportunities jobs available to the travelling worker. To give you an idea of the exotic places crying out for travelling workers check out this Work About Australia Sample Bulletin.

Alternatively, you can advertise yourself as available for employment on the No Boundaries web site https://noboundaries.com.au/work-travel/employment-wanted/

Work Around Australia While Traveling

Work your way around Australia while traveling and you can claim your trip as a tax deduction. This section of the BAN TACS website is for all travellers who are working their way around Australia and want to claim their trip tax deductions, whether they are backpackers, fruit pickers, shearers, trades people operating as a business or bar keepers and all the occupations in between. You will need to keep good travel records and BAN TACS Accountants provide this to you for free. Below you will find FREE documents that help you keep your travel records.

What to do When Your Work Causes You to Sleep Away From Home

If you sleep away from your home due to your work you have the potential to be able to claim your car, food and accommodation as a tax deduction. But you must have good records. Below are some worksheets and notes to help you put together the information you need to substantiate your claim. To the right are links to more free information on the concept, how to collate your information so we can prepare your tax return, other services available for travellers and if you prefer the personal approach look up the workshop timetable for when Julia will be in your area or contact her to come to you.

Why do we provide FREE products?

No, we are not altruistic. Through the free products we provide we hope to lead you to the understanding that BAN TACS Accountants Pty Ltd knows what it’s doing. We understand the tax law that allows you to claim your travel expenses and we provide a mail-in service that we hope you will use. Julia Hartman, founder of BAN TACS, travels all around Australia using these record keeping techniques. She meets many other travelers on the way and provides free ‘Claim Your Trip Around Australia’ seminars to help others understand the tax law as it applies to their circumstances. BAN TACS has been built by providing free products and free information such as is available on this page and we will endevour to continue with this practice.

FREE Travel Documents to Help You Maximise Your Tax Return

All the documents provided are FREE. Each document contains an explanation to its use and purpose so browse around, it’s worth your while if you want to maximise your tax return. For further information on how all this works, visit our page that explains the concept on how you can maximise your tax return and claim your trip around Australia as a tax deduction.

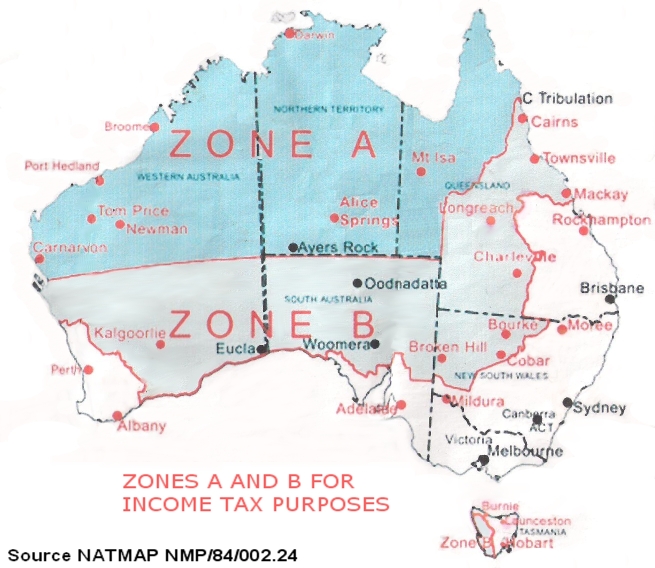

Income Tax Zones in Australia

Australia has a Zone A and a Zone B for income tax purposes. The following map is to help you know what Zone you are working in and will help you with your income tax claim